WINGX Global Market Tracker:

Bizjet activity tilts up despite sharp slowdown in Middle East

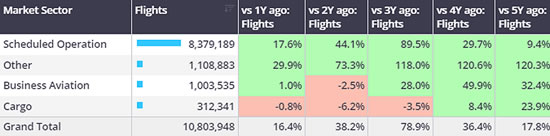

So far this month (1st-14th April), global bizjet sectors are 6% ahead of comparable last year, trailing 2022 by 5%, 34% ahead of 5 years ago, according to WINGX`s weekly Global Market Tracker published today.

For week 15 (8th-14th April) global bizjet sectors are up 4% compared to same week 2023. By comparison, scheduled flight activity so far this month is up by 23% compared to last year, 14% ahead of 2019. Cargo sectors are 4% ahead YOY, 21% ahead of 5 years ago. Year to date, bizjet sectors are 1% ahead of last year, 24% ahead of 2019.

1st January-14th April 2024 activity by sector, compared to previous years.

(Business jets only).

[click image to enlarge]

United States

In Week 15, 51,779 business jet sectors were flown in the United States, 2% more than the previous week, 4% more than Week 15 in 2023. So far this year (1st January-14th April 2024), US bizjet activity is 1% ahead of last year, 5% below 2022, 29% ahead of comparable 2019.

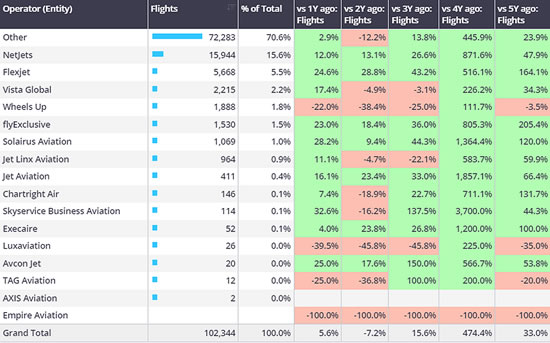

So far this month (1st-14th April), US bizjet departures are 6% ahead of 2023, 7% below 2022, 33% ahead of 2019. A number of operators are seeing all-time peaks in activity, notably Netjets, Flexjet, flyExclusive and Jet Aviation.

Top bizjet State this month is Florida, although activity has slipped 9% in Week 15. Palm Beach International is the busiest airport in Florida this month, although activity is behind April 2023, 2022 and 2021. Fractional operators are flying more sectors out of Florida airports than any previous April, sectors 8% ahead of last year, contrast Branded Charter and Corporate Flight Departments where sectors are 16% and 14% below last year. The busiest Fractional connection from Florida this month is Palm Beach-Teterboro.

Operator ranking, US bizjet departures 1st-14th April 2024 vs previous years.

[click image to enlarge]

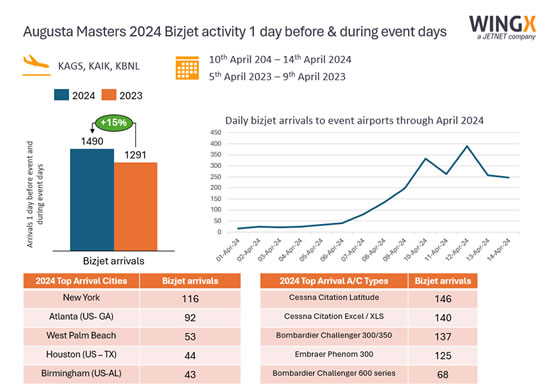

Elsewhere in the US, the hosting of the Augusta Masters last week (10th-14th April 2024) had a significant impact on bizjet flight activity at nearby airports (KAGS, KAIK, KBNL). 1,490 bizjet arrivals were recorded one day before and during the event days, 15% more than the 2023 event. Most arrivals came from New York, the Cessna Citation Latitude the most popular aircraft.

Augusta Masters 2024.

[click image to enlarge]

Europe

In Week 15, European business jet activity fell 1% below comparable Week 15 2023, though volumes were 10% up on Week 14. So far this year, European business jet activity is 2% down on same period 2023, flat compared to 2019.

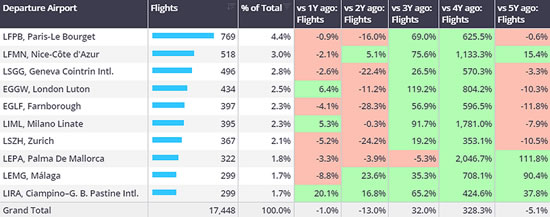

So far in April, European bizjet activity is 1% behind last year, 13% behind 2022, 5% below 2019. France, United Kingdom and Germany are the top 3 markets this month, Germany the only market to see Year-on-year growth, all three behind 2019. All three of the busiest airports this month are seeing YOY declines, Le Bourget 1% behind 2019. Several of the busiest airports are in decline compared to April 5 years ago, Nice and Palma de Mallorca notable exceptions.

Connections with the Middle East this month have fallen 7% YOY, 2% below April 2019. Russia-United Arab Emirates is the top Europe-Middle East country flow, bizjet sectors 50% ahead of last year, 90% ahead of 2019. European bizjet connections to Israel are down 46% YOY, top connection between Europe and Israel is Greece-Israel. European connections to Saudi Arabia are up 11% compared to last year.

Top European bizjet airports, 1st-14th April 2024 vs previous years.

[click image to enlarge]

Rest of the World

In Week 15, bizjet activity in the Middle East fell 8% compared to the previous week, falling 20% behind Week 15 in 2023. Year to date, Middle East bizjet activity is 7% behind 2023, 47% ahead of 2019.

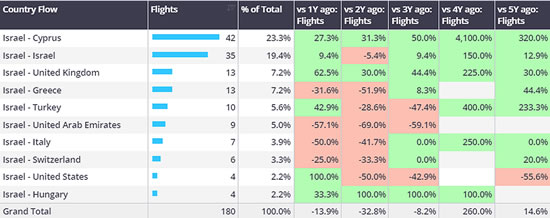

So far this month bizjet activity in the Middle East is trending 16% behind last year, although 13% ahead of 2019. Activity out of United Arab Emirates, Saudi Arabia and Israel are 8%, 65% and 14% below last April. Dubai is the largest metro area for bizjet departures, 11% down YOY, third ranked Tel Aviv 13% down YOY. Cyprus is the top bizjet connection out of Tel Aviv, connections up 23% YOY. Connections with the UK are up 63% YOY. Middle East connections with Greece, UAE and Italy down 32%, 57% and 50% respectively.

Outside of the US, Europe and the Middle East, Mexico is the busiest bizjet market, sectors 12% ahead of last year. Sectors are up 99% YOY this month in China, flights in Canada are up 5% and bizjet departures from Brazil are up 50%.

Bizjet county connections from Israel, 1st-14th April 2024 vs previous years.

[click image to enlarge]

Managing Director Richard Koe comments: “Geopolitical tensions are visibly impinging on bizjet demand, with flights in the Middle East dropping off 20% in Week 15. The European market has idled this year, stagnating around the same levels of demand 5 years ago.

"The US market is still growing, especially for the top operators. Bizjet visitors to airports hosting the Masters golf tournament were up by 15% compared to last year’s event.”

“Geopolitical tensions are visibly impinging on bizjet demand, with flights in the Middle East dropping off 20% in Week 15.

"The European market has idled this year, stagnating around the same levels of demand 5 years ago.

"The US market is still growing, especially for the top operators. Bizjet visitors to airports hosting the Masters golf tournament were up by 15% compared to last year’s event.”

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 18th April 2024 | Issue #744

| © BlueSky Business Aviation News Ltd 2008-2024 |