|

There were 76,983 business aviation departures in Europe in September 2016 according to

WINGX`s latest monthly Business Aviation Monitor, representing 1.4% YOY growth in activity.

The growth came in business jet activity, flights up 4% YOY, offsetting declines in turboprop

and piston activity.

Regions

The UK had most growth this month, with flights up 5%. The increase was most evident in

London, with Large Jet departures up 7% and Light Jet flights up by 12%. On average there

were 150 business aviation flights a day leaving the UK during September.

The Busiest country in September was France, generating 19% of all European departures.

YOY trend in France was flat, whilst YTD trend was up 3%. France saw an additional 350 flights

per month in 2016. Spain enjoyed a 12% increase in departures this month, mainly in Owner

flights.

The major markets experiencing decline this month were Germany and Switzerland. Flights

within Germany were down 8%, and Charter departures from Germany fell 11%. Business jet

flights in Germany were flat; all the decline was in prop activity.

Overall, flight activity within Western Europe was flat this month, the growth coming in Southern

and Eastern Europe, although both Turkey and Russia markets continued to decline.

Transatlantic flights were well up this month - arrivals up by 8% YOY.

Owner flights were flat and have been declining most of the last 12 months. In contrast AOC

flights were up, growing as they have been in all but two months this year. Business jet AOC

flights were up exceptionally, +7% YOY. The growth in AOC flights was evident in recovering HJ

and LJ activity, both up 8%. SMJ activity was up >20%, mainly reflecting replenished fractional

fleets. VLJ activity was up 15% overall, and 18% YOY in terms of Charter sectors flown.

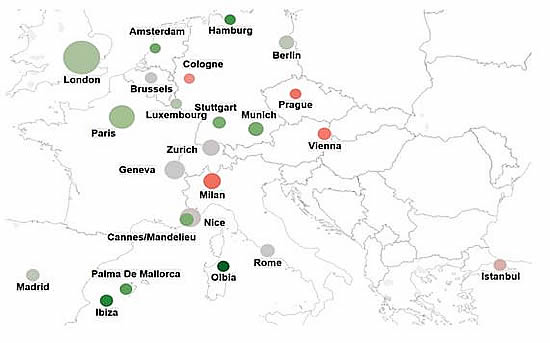

| Cities with most business aviation flights

|

|

|

Central Europe slightly declines, but London and Paris made big gains.

|

Aircraft

In the VLJ segment, Mustang flights were up 10%

YOY, Phenom 100 activity by 26%. Overall, Cessna aircraft flew 2% more YOY, Embraer aircraft up 24%, Bombardier up 14%, but

Beechcraft and Hawker aircraft down 7% and 11% respectively.

Airports

Four of the busiest five airports were flat this month, Le Bourget the exception with 5% YOY

growth in departures. Other airports with substantial growth this month included Biggin Hill, up

10%, Farnborough up 13%, Ibiza up by 17%.

Richard Koe, Managing Director of WINGX Advance, comments:

“This month completed a positive 3rd Quarter, adding to the growth in Q2, and offsetting the bad

start to the year, so that overall trend is now line with 2015. September was actually unusually

strong, especially for business jet charters. The UK and Spain got a big share of the growth, the

tourist season extended by the long late summer. VLJ charters played a big role in supporting

this demand. Aggregate activity was also boosted by new deliveries into Super Midsize fleets.”

Download

the current Business Aviation Monitor

WINGX

Advance is a data research and consulting

company based in Hamburg, Germany. WINGX

analysis provides actionable market intelligence

for the business aviation industry. WINGX

services include: Market Intelligence Briefings,

Customised Research, Strategic Consulting,

Market Surveys. WINGX customers range from

aircraft operators, OEMs, airlines, maintenance

providers, airports, fixed base operators, fuel

providers, regulators, legal advisors, leasing

companies, banks, investors and private jet

users. |