|

There were 58,111 business aviation departures in

Europe in November 2016, according to WINGX`s latest monthly Business

Aviation Monitor. The figure represents a 0.8% growth in YOY activity.

In six of 11 months so far this year there has

been some YOY growth, although the YTD trend is still trailing 2015 by 0.2%.

The YOY trend in November was offset by

declines in Turboprop and Piston activity; Business Jet flights were up 3% in

November and now have a positive 12 month rolling average, with Small Jet

activity providing most of the growth.

Business aviation flights from Western Europe

were up in November, bolstered by growth in UK, France and Italy, which

outweighed declines in Germany, Switzerland and Spain. Southern Europe was flat

this month, and Eastern Europe slightly down.

YOY growth in AOC flights exceeded 10% in

France and Italy, and were up 4% in the UK, in contrast to flat or declining

Private flights in all 3 markets. Germany had the largest overall decline, 297

fewer flights YOY. Spain saw the biggest AOC decline, -8% YOY.

Elsewhere in Europe, largest declines came in

Poland and Belgium. Declines in Turkey and Russia have bottomed out;

respectively down 3% and 1% this month. There was substantial growth this month

in the Nordics, also in Portugal and Czech Republic.

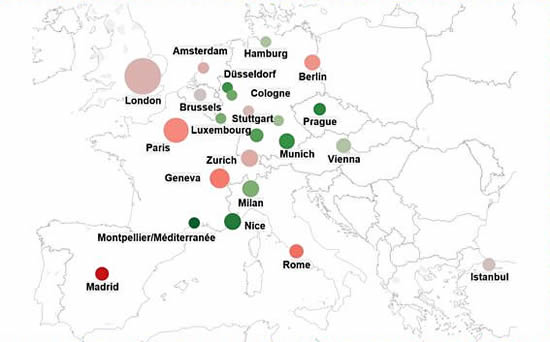

| Cities with most business aviation flights

|

|

|

Despite overall decline,

demand up in several European cities. Strong growth in Nice.

|

Aircraft

Private flights declined 1% YOY, although this

was due to a big drop in Piston activity; both Jet and Turboprop activity

increased slightly. So far this year, overall Private flights have declined in

most months, in contrast to AOC activity, mostly gaining.

Increased AOC flights is evident in growth of

Cessna, Beechcraft, Bombardier, Embraer and Gulfstream activity. Bombardier

aircraft YOY activity was strongest in Heavy and Super midsize. In contrast to

Dassault and Gulfstream, Bombardier ULR activity declined.

Across the fleet, ULR activity continued to

increase in November, flight hours up 6% YOY. SMJ, SLJ and LJ segments also saw

increased flying, although the outstanding growth this month came in the VLJ

segment, sectors increasing 20% YOY.

Airports

Business aviation activity was down at the top

airports this month, including Le Bourget, Geneva, and especially Farnborough.

Nice was an exception, with >15% YOY growth in departures. AOC activity was also

stronger at Linate and Munich.

Richard Koe,

Managing Director of WINGX Advance, comments:

“Business aviation activity was only slightly

up in November, not enough to change the YTD decline compared to last year.

However, slowdown in Piston and Turboprop activity is weighing down the trend;

underlying business jet activity was up this month, and the business jet charter

market has been quite lively for a number of months, especially in the lighter

jet segments.”

Download

the current Business Aviation Monitor

WINGX

Advance is a data research and consulting

company based in Hamburg, Germany. WINGX

analysis provides actionable market intelligence

for the business aviation industry. WINGX

services include: Market Intelligence Briefings,

Customised Research, Strategic Consulting,

Market Surveys. WINGX customers range from

aircraft operators, OEMs, airlines, maintenance

providers, airports, fixed base operators, fuel

providers, regulators, legal advisors, leasing

companies, banks, investors and private jet

users. |