|

There were 53,526 business

aviation departures in Europe in February 2017 according to WINGX`s latest

monthly Business Aviation Monitor published this week.

The figure represents 0.9%

growth compared to Feb-16 (which was 1 day longer). The YTD trend is now +2.6%;

so far, 2,602 more flights in 2017 than in 2016.

Business jets operated 62%

of business aviation flights in February, increasing activity by 4% YOY. The

overall trend was held back by Turboprop and Piston activity, down 4% YOY. The

rolling 12-month trend in business jet activity is just above 2%.

February’s activity was

bolstered by stronger activity in Germany, flights up by 5% YOY. AOC activity

from Germany is generating the growth, up 10% YOY. Mainly the recovery is coming

in business jet rather than in turboprop activity.

France continued to grow,

less than in January, but still up by 473 flights a month so far this year. Much

of the growth came from Le Bourget, departures up 4%, of which AOC missions

gained 11% YOY. UK was also up, with daily departures to Europe +2.8%.

Flights from Western Europe were up 1%, +2% from Southern Europe, but down 6%

from Eastern Europe. Departures from Middle East and North America into Europe

were down, but arrivals from Russia climbed 10% YOY.

|

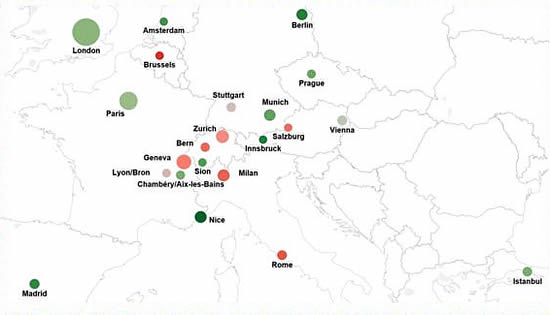

Cities with

most business aviation flights |

|

|

London &

Paris up, strong growth in Madrid & Berlin, decline in Geneva and

Rome |

Private flights comprised

47% of all activity in February, volumes down 3%, in contrast to AOC sectors, up

6% YOY. Jet and Prop Private flights declined 1% and 5% respectively. Business

jet AOC sectors increased by 8.5% YOY.

AOC activity was up in all 7

top markets, including Italy. AOC departures from Spain increased 10% YOY, from

Russia, +14%, and from the Netherlands, 28%. Apart from Germany, Private

missions declined across the same top 7 markets.

Aircraft

In terms of operated hours, all

business jet segments except heavy jets were up this month. ELJ & VLJ hours

increased >10%. ULR flights were up 10%, reflected for example in a big pick-up

for Falcon 7X and Global Express aircraft.

Airports

Business aviation activity

declined at 3 of the busiest 4 airports - Luton, Geneva and Zurich. But apart

from Zurich, AOC activity was up in the top 7. Largest growth in AOC activity

came from Nice and Vnukovo, respectively growing 21% and 30% YOY.

Richard Koe,

Managing Director of WINGX Advance, comments: “Allowing for the shorter month,

February showed solid YOY growth for business aviation activity in Europe. The

resurgence is coming in business jet activity, and clearly from AOC operations

rather than Private flights, as we’re seeing owners fly consistently less over

the last year. Activity growth appears to be coming from new ultra-long range

and super midsize aircraft coming into owned and operated fleets, also from the

success of online brokerage platforms and membership schemes focused on getting

higher utilisation from light jet inventory.”

Download the current issue of the Business Aviation Monitor

WINGX

Advance is a data research and consulting

company based in Hamburg, Germany. WINGX

analysis provides actionable market intelligence

for the business aviation industry. WINGX

services include: Market Intelligence Briefings,

Customised Research, Strategic Consulting,

Market Surveys. WINGX customers range from

aircraft operators, OEMs, airlines, maintenance

providers, airports, fixed base operators, fuel

providers, regulators, legal advisors, leasing

companies, banks, investors and private jet

users. |