October´s business aviation activity came down

from the summer's peak, but was still up 8% YOY - with business jet charter

flights up by 13% YOY - according to WINGX`s latest monthly Business Aviation

Monitor.

The YTD trend climbed to 4%, an additional

28,000 flights this year compared to 2016.

The largest markets contributed most growth,

with Western Europe showing robust increase in flight activity, especially in

France, Spain and Italy. There was an increase of over 1,000 flights YOY from

France this month.

There were small YOY declines in activity from

Russia, Norway and Turkey, but strong gains from other smaller markets such as

Sweden, Austria and Greece. YTD, Germany has seen the most growth, flights up by

3.9%, an additional 415 flights per month.

Business aviation flights from Southern Europe

were up by 10% this month, and have a 12-month growth trend of 7%. Arrivals into

Europe from Russia were down 2%. There was slight growth in flights to the

Middle East, and a 9% bounce in flights from Europe to North America.

There was some recovery this month in Private

flights, up 5% YOY, in contrast to stagnation over much of the last 12 months.

But all this growth came from 10% gain in Prop activity. Business jet Private

missions slipped back 0.4% YOY.

|

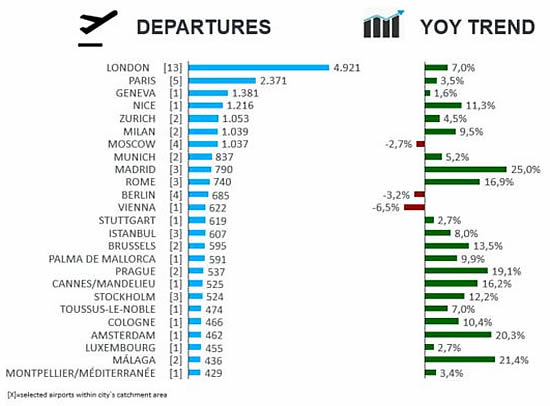

Activity trend by City |

|

|

Almost 5,000 departures out of 13 London

airports; up 7% compared to last year. |

Aircraft

Cessna aircraft were 6% busier this month,

with 7% increase in VLJ flights and over 100% growth in Cessna´s Midsize

activity. In the ULR segment, Gulfstream activity was up by 13%. Embraer Heavy

Jet flights were up >30%, Hawker Light Jets by 19%. Bizliner and Entry Level Jet

activity was down this month. All other segments were up, especially Piston AOC

activity. Light, Very-Light and Heavy Jet flights were up >12% YOY. VLJ Private

flights were up by 20% YOY.

There were more than 3,000 PC-12 flights this

month, up by 34% YOY. King Air 200, Excel/XLS and Mustang Charter activity was

slightly up. Legacy 600 and Phenom 300 had most growth in Charter. Falcon 2000

Private flights were up 10%.

Airports

Almost all the busy airports saw an increase

in YOY activity this month, although Private flights from Geneva and Luton were

down. Nice added most YOY activity, a 13% gain. 16% growth at Farnborough and

Biggin Hill, more than 25% growth at Barajas airport.

Richard Koe,

Managing Director of WINGX Advance, comments: “October activity came down off

the summer peaks, as usual, but the strong YOY growth, the largest so far this

year, points to a sustained growth in charter demand. This is evident across

almost all business jet segments, most notably in heavy jets. The market appears

to be responding to a better outlook for the economy, and within the industry,

competitive pricing, aggressive marketing and more productive underlying

operating and brokerage models."

Download the latest Business Aviation Monitor

WINGX

Advance is a data research and consulting

company based in Hamburg, Germany. WINGX

analysis provides actionable market intelligence

for the business aviation industry. WINGX

services include: Market Intelligence Briefings,

Customised Research, Strategic Consulting,

Market Surveys. WINGX customers range from

aircraft operators, OEMs, airlines, maintenance

providers, airports, fixed base operators, fuel

providers, regulators, legal advisors, leasing

companies, banks, investors and private jet

users.