June Fleet For Sale percentages down for all sectors; bizjets 'lowest since great recession'

JETNET has released June 2018 and the first six months of 2018 results for the pre-owned business jet, business turboprop, helicopter, and commercial airliner markets.

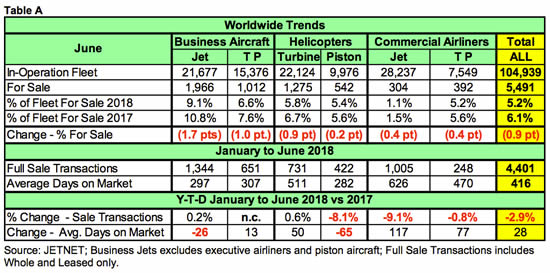

Key worldwide trends across all aircraft market segments were compared from June 2018 to June 2017. 'Fleet For Sale' percentages for all sectors were down in the June comparisons. June 2018 was the lowest 'For Sale' percentage (9.1%) for business jets since the great recession began.

Trends

Generally, across all six aircraft sectors reported, inventories are down, and full sale transactions had mixed results, with very little increase to no change to decreases in the first six months of 2018 versus 2017.

Business Jets are showing a flat start in the first six months of 2018, with a .2% increase in pre-owned sale transactions, but are taking less time to sell (26 days) than last year. Business turboprops saw no change in sale transactions, while taking more time to sell (13 days). Interestingly, New Business Jet shipments as reported by GAMA were also flat in the first six months of 2018 compared to 2017, at 296.

Comparing June 2018 to June 2017, turbine helicopters saw a slight increase in YTD sale transactions, up 0.6%, while piston helicopters showed a decline of 8.1% in sale transactions.

Commercial airliners are also reported by JETNET, and include the number for sale for both commercial jets (including airliners converted to VIP) and commercial turboprops. Commercial Jets and Commercial Turboprops were down in full sale transactions, at -9.1% and -.8% respectively, in the YTD June-over-June comparisons.

For the first six months of 2018 there were a total of 4,401 aircraft and helicopters sold, with business jets (1,344) and commercial jets (1,005) leading all types and accounting for 53% of the total. The number of sale transactions across all market sectors - at 4,401 - decreased by 2.9% compared to the first six months of 2017. Only pre-owned business jets and turbine helicopters showed increases in sale transactions compared to the other market sectors. However, they were both less than 1%, and business turboprops had no change.

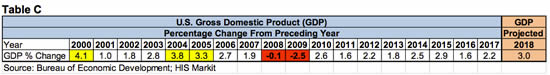

US Real Gross Domestic Product (GDP)

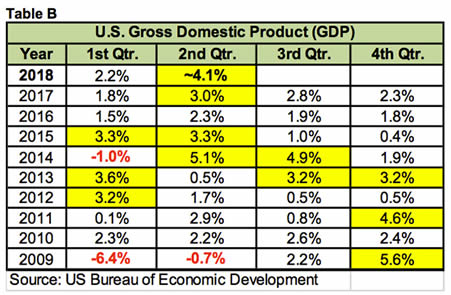

The first six months flat results for business jets were surprising, because the US real gross domestic product (GDP) increased at an annual rate of 4.1% in the second quarter of 2018. In the first quarter of 2018, the US GDP increased by 2.2 percent.

The second quarter of 2018, at 4.1%, is the second highest since 2014 (at 5.1% for second quarter results).

In an analysis of yearly US GDP percentages from 2000 to 2017, the year 2017 was 2.2%, and 2018 is projected to be 3.0% for the US, as sourced from the IHS Markit Ltd. Comparative World Overview report from July 2018.

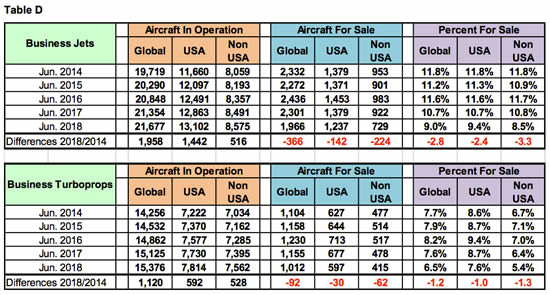

Global, USA, and Non-USA Pre-Owned Market Trends

Business jets and business turboprops were compared for the months of June from 2014 to 2018 (four years) for the USA vs. Non-USA Aircraft In Operation, For Sale, and Percentage For Sale.

The general trend has been that growth in business jets has out-paced turboprops nearly 2-to-1 in the last four years. Since June 2014, 1,958 new business jets have joined the global fleet, compared to 1,120 turboprops.

The number For Sale and Percentage For Sale have declined since 2014. The split of USA vs. Non-USA business jets in operation has remained at 60/40 levels, whereas the split of in-operation USA vs. Non-USA business turboprops is about 51/49. Interestingly, the number for sale in the USA vs. Non-USA is 63/37 for business jets, and 59/41 for business turboprops.

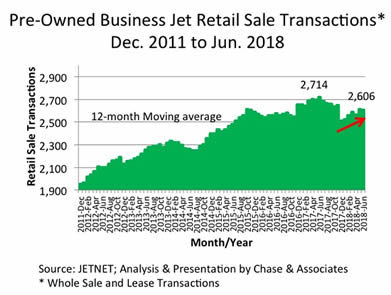

Pre-Owned Business Jet Transactions

An analysis of the 12-month moving average for Full Retail Transactions for business jets from December 2011 to June 2018 showed that from December 2011, used business jet transactions steadily increased to a high point of 2,714 in June 2017. A falling-off occurred in the second half of 2017, to a low point in December 2017 of 2,506, and has since steadily increased to 2,606 transactions in June 2018.

© BlueSky Business Aviation News Ltd 2008-2018