United Kingdom

Six aviation loss trends on the radar: Allianz Global

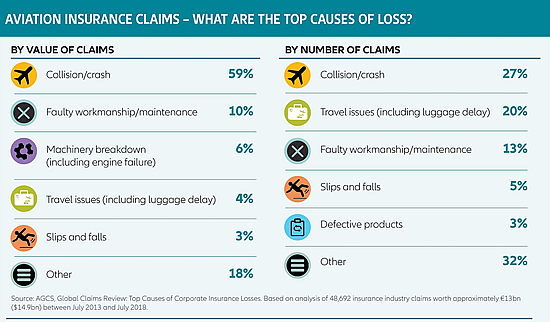

Collision/crash, maintenance and machinery breakdown are top three causes of insured losses

Cyber risk voted number one concern by aviation risk experts in future

Aviation collision/crash incidents are the second top cause of insured losses globally overall, behind fire and explosion incidents, according to analysis from Allianz Global Corporate & Specialty (AGCS).

The analysis was based on more than 470,000 insurance industry claims over the past five years.

Aviation claims from this data set show collision/crash incidents account over half the value of all claims (59%) and more than a quarter by number (27%). Such incidents do not just include major crashes; they also incorporate events like hard landings, bird strikes and runway incidents such as incursions and excursions (the average claim for which is now almost €1.4m ($1.6m).

Despite a number of crashes, the global airline industry has also experienced some of its safest years ever in recent times, yet the number of claims shows no sign of abating. Human error, rising repair costs from composite materials and higher value engines, an increase in ground incidents at more congested airports and a growing reliance on automation are just some of the main factors influencing loss activity.

1. Safety milestones and losses continue

With more reliable engines and technology and following significant improvements in airline risk management, serious accidents are far fewer. According to the International Air Transport Association (IATA), there was just one major accident for every 8.7 million flights in 2017 - over four billion travelers flew safely on 41.8 million flights.

“For the first time in more than 100 years of aviation history in 2017 there were no fatalities on a commercial airline, a remarkable achievement by any measure,” says Kevin Smith, Global Head of Aviation Claims at AGCS. “This is not an aberration. Flying has become a much safer mode of transport and is the result of the considerable efforts of aircraft and engine manufacturers to get to this stage.”

With more than one million people in the air at any one time, this impressive statistic is to be applauded but 2018 and 2019 to date have seen a number of fatal airline accidents, the worst being the loss of a Lion Air Boeing 737 off Indonesia in October 2018 which went down shortly after take-off with the loss of 189 people. Similarly, on March 10, 2019, an Ethiopian Airlines 737 crashed after take-off with the loss of all 157 passengers. These incidents followed the loss of a Cubana de Aviación Boeing 737, in May 2018, with 112 passengers and crew. In addition 2018 also brought a number of total hull losses, where all passengers survived. For example, a Pegasus Airlines Boeing 737 was written-off after it overshot the runway at Trabzon Airport, Turkey in January, while a Xiamen Airlines Boeing 737 was declared a total loss after it crash-landed in bad weather in August. In total, 2018 saw a total of 15 fatal airliner accidents, resulting in 556 fatalities, but this still ensured it was the third safest year ever by the number of fatal accidents and the ninth safest in terms of fatalities, according to the Aviation Safety Network.

2. Human error a major loss factor

Technological advancements and improved quality control of aviation manufacturing and maintenance has significantly reduced the number of accidents caused by mechanical or structural failure. Consequently, human error has become a more significant cause of loss.

“Pilot error is a major factor behind many aviation accidents,” says Smith. “It has been estimated that as many as 95% of airline accidents involve human error in some capacity. Aircraft are now very safe but most accidents involve errors of judgement, such as taking off in bad weather or the way in which a pilot reacts in adverse conditions.”

3. Increasing claims frequency and aircraft values

While catastrophic air crashes are now far less frequent, the overall frequency of aviation claims is slightly up, due to factors such as higher repair costs, increased values at risk and the relatively low deductibles maintained by airlines in what has become a highly competitive aviation insurance market. The average deductible at $1mn today is around the same as it was in 1982, yet aircraft values have increased three fold, Smith explains.

Despite few major losses and no fatalities in 2017, the aviation insurance market barely broke even - a reflection of market conditions and attritional losses while 2018 represented the sixth consecutive year where airlines claims exceeded premiums according to broker JLT.

Claims frequency is up, but this is not the only factor. “The size of loss has increased and deductibles have not kept pace with technology and values. A $5m loss today would probably have cost just $1m five years ago and been within the deductible," says Smith.

4. Costly composite materials and more expensive engine repairs

The use of composite materials in aircraft manufacturing really took off around a decade ago, and today the majority of the world’s commercial airline fleet now relies on such materials. Composites - such as carbon fiber layers bonded with resin - are strong, but also light, therefore reducing weight and increasing fuel efficiency. Such materials are now used extensively in modern aircraft - some 50% of Boeing’s 787 Dreamliner is made of composite materials by weight.

“Composite materials have many benefits, but they can be more challenging and expensive to repair,” says Smith. “Aircraft manufacturers may not have envisaged the realities of repairs when developing these materials a decade or so ago.”

The claims experience has revealed a higher repair cost associated with composite materials which are generally more expensive to manufacture than traditional metal alloys, more labor intensive to repair and often require a larger repair area.

“We are now at the stage where we have had some seven or so years of claims experience with composite materials and we can say that composite aircraft are more expensive to repair,” says Smith. For example, a claim involving a fire under the front landing gear of a 787 cost $13m to repair. The same incident for an older generation metal alloy aircraft would have cost somewhere between $3m and $4m.

While safer and more reliable, aircraft engines are also now much more expensive to repair or replace. Top-of-the-range engines used on the Airbus A350 can easily cost more than $40m each - just under the value of a whole 737 a decade ago. The drive for fuel efficiency has resulted in lighter engines that fly longer distances. However, technical advances such as the use of new materials and thinner, lighter turbine blades have reduced the tolerances at which engine components operate while the cost of spare parts has also increased.

5. Congested airports bring more ground incidents

In addition to increased repair costs, insurers are seeing more attritional claims. The rapid growth in air travel - the number of air passengers is expected to double to 7.8 billion by 2036 has resulted in more congested skies and airports.

“With increased air travel, congestion in and around airports has become an issue,” says Smith. “In many cases airport infrastructure has not kept pace with the rapid growth in passenger and aircraft numbers. With more aircraft on the ground, servicing areas and aprons have become more congested and this is resulting in an increase in the number of collisions with other aircrafts or ground handlers.”

Analysis of 523 loss events at 14 German airports last year by AGCS shows that damage to vehicles on the tarmac is the leading cause of insured losses. More than half of these events are due to collisions with pushback tractors, baggage trolleys, aerial work platforms or washing systems.

For example, the introduction of a new form of tow-truck (that wraps-around an aircraft’s front landing gear) has resulted in several large claims. A number of tow-trucks have caught fire while in operation, damaging aircraft – one resulted in the total loss of a Boeing 777.

6. New loss drivers: cyber and reliance on technology

Aircraft and airlines are increasingly reliant on technology - from aircraft to ticketing. An A350 aircraft today sends some 400,000 computer messages to ground controllers during a six hour flight, 60% more than the older A380.

The technology for crew-less commercial passenger aircraft already exists, but the reality is many decades away. However, aircraft are likely to become increasingly automated, driven by the desire to reduce costs and because of the predicted shortage of pilots - Boeing has said over 600,000 pilots will need to enter the industry over the next 20 years. According to Smith, flights with just one crew member on the flight deck, with ground support, would have implications for crew skills and training, as well as how they deal with adverse conditions.

Then there is the threat to the sector posed by technology or cyber-related losses, such as physical damage to aircraft or business interruption such as IT system outage. Cyber risk ranks as the number one concern for the aviation sector for 2019, according to the eighth annual Allianz Risk Barometer which surveys industry risk experts. To date, there have not been any major aviation claims triggered by a cyber incident, although insurers have paid out on some indirect cyber claims. For example, AGCS settled a liability claim from passengers seeking compensation for flight cancellations caused by a ticketing system failure.

While crewless passenger aircraft are some way off, autonomous flight is an emerging area for aviation insurance claims. AGCS has a growing global book of drone insurance, and has seen a corresponding increase in claims. As drone use broadens into different areas, claims will become more relevant, says Smith.

Allianz Global Corporate & Specialty (AGCS) is a leading global corporate insurance carrier and a key business unit of Allianz Group, providing risk consultancy, Property-Casualty insurance solutions and alternative risk transfer for a wide spectrum of commercial, corporate and specialty risks across 12 dedicated lines of business.

Worldwide, AGCS operates with its own teams in 34 countries and through the Allianz Group network and partners in over 200 countries and territories, employing over 4,400 people. In 2018, AGCS generated a total of €8.2 billion gross premium globally.

www.agcs.allianz.com

BlueSky Business Aviation News | 16th May 2019 | Issue #511

Share this article