Some recovery in business jet charters but owner activity slumps

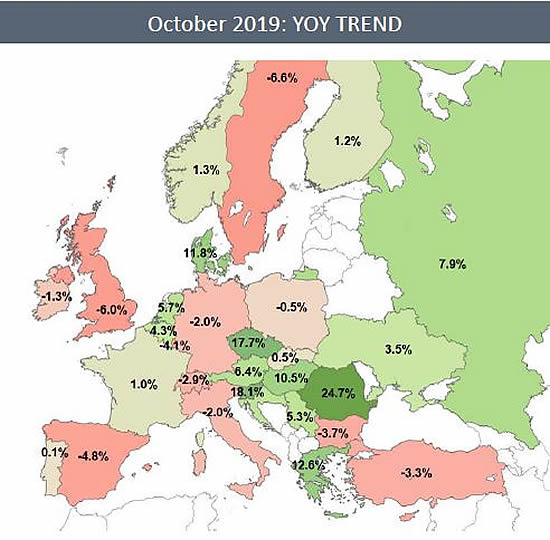

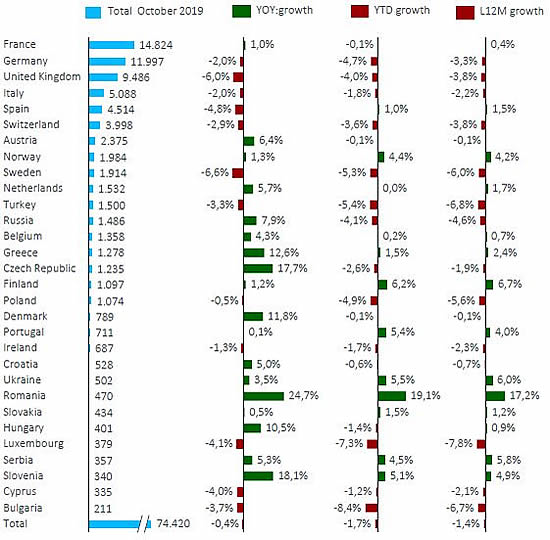

There were 74,420 business aviation departures in Europe during October 2019 according to WINGX`s latest monthly Business Aviation Monitor published today.

The figure indicates a flat YOY, and although business jet AOC activity was up for the first time this year, Private/Owner jet flights declined by 5% YOY. Prop activity was down; Piston flights were up.

Activity was up in France this month, in contrast to declines in other major markets, notably a 6% drop in flights out of the UK. Germany suffered the most decline this year with activity down by 5%. As a whole, the last 12-month trend for Europe is -1.4%.

Activity was up in France this month, in contrast to declines in other major markets, notably 6% drop in UK. Germany has most decline this year, down by 5%. L12M trend is 1.4%.

Aircraft

France activity was boosted by Prop activity; in Germany, Large Jet activity fell 6%, with Italy and Spain falling by 10% and 15% respectively. The UK had 2.7% increase in Large Jet activity.

Charter activity was up in Germany, in contrast to a big drop in Private missions, also down in UK, Italy, Turkey and especially Spain. The charter market slumped in Sweden, but was well up in Russia. Turkey and Russia both had more than 10% growth in Large Jets.

Paris saw a big drop-off in activity in October with departures down by 9%. Similarly, there were large drops from Milan and Stuttgart. Zurich was well up in Large Jets and Nice in Small-Mid Jets. Across Europe, Super-Mid 1.5h-3h sectors were up by 12% YOY.

Flights within Europe were flat in October, now trending down 1.5% in L12M. Flights to North America from Europe, averaging 7.7H/sector, are up 3.7% in L12M. The fastest growing pair for Charters this month was LIMC (Malpensa, Italy) to LFPB (Paris Le Bourget).

Ultra Long-Range segment activity dropped off this month, although Bombardier and Embraer Heavy Jet flights were well up. Super-Mid activity in the Embraer fleet was up by 42%. Embraer Light Jet flights were up by 10% YOY.

Airports

LFPB (Paris Le Bourget) activity fell 9%, in line with a 8% YTD decline. EGLF (Farnborough) continued to see strong growth activity up 13% in contrast to flat EGGW (London Luton) trend and declining EGKB (London Biggin Hill) activity. LFMN (Nice Cote d' Azur) activity was up 5% YOY in October, although down 5% YTD.

EGLF (Farnborough) activity got a boost from Small-Mid activity, up 16% this month. LSGG (Geneva) and LFPB (Paris Le Bourget) well down in this category. Large Jet activity was well up in LSZH (Zurich), EGKB (London Biggin Hill) and LKPR (Ruzyne, Czech Rep.). LFMN (Nice Cote d' Azur) AOC activity grew 12% in October but trending down by 5% this year.

Richard Koe, Managing Director of WINGX, comments: “October’s flight activity shows some stabilisation in demand after several months’ of decline. Business Jet AOC traffic was up for the first time this year. Heavy and Super-midsize aircraft are flying more, especially in fractional and charter fleets. This is reflecting a raft of new aircraft models coming into the market in the last 18 months, notably the Citation Latitude and new Bombardier Global jets. Clearly there is still volatility in the market, with big dips in activity in key hubs such as London and Paris this month. Overall, business aviation is on track to lose around 2% of activity in this year versus last.”

WINGX is a data research and consulting company based in Hamburg, Germany. WINGX analysis provides actionable market intelligence for the business aviation industry. Services include: Market Intelligence Briefings, Customised Research, Strategic Consulting, Market Surveys. WINGX customers range from aircraft operators, OEMs, airlines, maintenance providers, airports, fixed base operators, fuel providers, regulators, legal advisors, leasing companies, banks, investors and private jet users.

WINGX GmbH

Conventstr. 8 - 10 | Building A

D - 22089 Hamburg

Germany.

+49 40 32 84 69 78 phone | +49 40 32 84 69 79 fax

BlueSky Business Aviation News | 7th November 2019 | Issue #532

| © BlueSky Business Aviation News Ltd 2008-2019 |