|

NBAA-BACE: Talking charter - at NBAABy Alison Chambers, Emerald Media. |

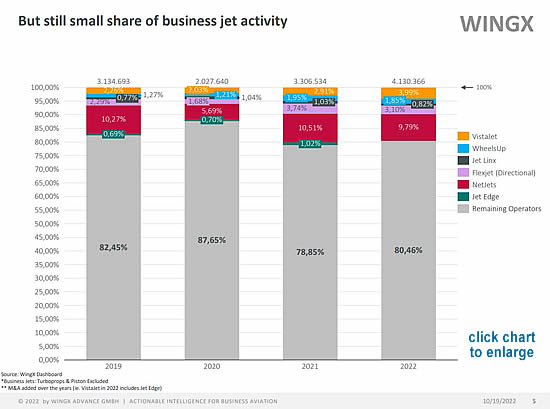

The return of corporate flying, improved operating margins, new entrants, disruption from lack of flight crew and spare parts availability, were the takeaways from an excellent ‘changing landscape of charter’ session hosted by UAS International Trip Support and brilliantly moderated by Richard Koe, Managing Director at WINGX, during NBAA.

Alison Chambers reports from Orlando:

UAS’ The Forward Discussion panelists were Wendi Matthews-Ortiz, Vice President, Executive Aviation, Hunt & Palmer USA; Andrew Ladoceur, Director of Charter Services, Short Hills Aviation; Andy Hodgson, Commercial Director, ACASS and Chris Clayton, Commercial Manager, Private Aviation, London City Airport.

UAS' The Forward Discussion Panel (L to R): Andy Hodgson, ACASS | Wendi Matthews-Ortiz, Hunt & Palmer Chris Clayton, London City Airport | Andrew Ladouceur, Short Hills Aviation | Richard Koe, WINGX.

The best news is that we are getting the corporates back, stated Wendi Ortiz- Matthews. “We did our first roadshow (unusually) in July and once one was in, they all started, almost queuing, to come back. Multi-day trips are beginning to come back too, along with music tours, and this will define 2023.”

Hitherto, the US market, like Europe, was doing exceptionally well - for leisure bookings. “We are a northeast US operator (with a Dassault Falcon fleet) and have been busy on trips like Aspen, Colorado, Palm Beach, Caribbean, Bahamas, along with new destinations too,” said Short Hills Aviation’s Andrew Ladoceur.

The return of corporate flying is welcomed across the Pond too. The emphasis on leisure wasn’t so good for London City Airport, admitted Chris Clayton, where our USP is our location. “Covid and the directive to work from home resulted in a number of our core (private aviation) customers relocate to buy homes near the coast. Thankfully, the return of corporates means we are 87% up on 2019, compared with last year, when it dipped just over 50%. We’ve also had aircraft types like the Pilatus PC-24, Mustangs, Citation XLS’s, in regularly, popular with first time users."

The biggest benefit to charter now is the pricing, added ACASS’s Andy Hodgson, with much improved yield. Talking from a European perspective he noted prices are back to the point they should be, at least 40% up pre-Covid, even though fuel and airport charges have increased.

“Business aircraft aren't being treated as a commodity in the same way they were pre pandemic. The economics do work for an owner, or potential owner, to buy (the right) aircraft. They can put it into the charter market, can have quiet enjoyment of 100 hours a year of their own flying and the chunks of revenues made will cover their own direct operating costs and the revenue on the fixed costs associated with aircraft ownership. This is already bringing in new entrants to the market and if revenues stay where they are, we're going to have a whole new generation coming into aircraft ownership and more (much needed) capacity to the charter market.”

Having crew to fly the aircraft remains a problem, however, alongside supply of maintenance parts, caused by supply chain disruption. Piilot retention is tough, said Andrew Ladoceur, noting the regional airlines are offering hefty bonuses to get pilots. On AOG disruption, I've had a very popular aircraft down for weeks at a time - waiting on something small like a brake pad or a tire. We have been buying a lot of our parts from other operators. “Luckily, that’s what’s great about our industry, the collaboration,” he added.

Could this improved appetite for business aviation open new models like hybrid, seat sharing ones, asked Richard Koe? The joy of flying through a commercial airport is still not what it was, so the hybrid model is an interesting way to gain new charter clients, test the waters and come into the market, the panel

Next, we turned to sustainability

Chris Clayton highlighted initiatives London City Airport, which sits within London’s ultra-low emission zone, has made its mission to be net zero by 2030. Over the past decade we changed pushback vehicles to fully electric ones and in the past 24 months swapped our entire fleet of mobile ground power units from diesel to fully electric. All our vehicles going landside to airside have to meet a certain mission as well. Becoming fully electric is the goal.

Hunt & Palmer offer a carbon offsetting programme and anytime an operator offers a similar programme, we opt into it, because we want to give back to the planet, said Wendi. Since Covid there was more an emphasis on personal health, but I hope it switches back, she said.

Speaking personally, we not doing enough as an industry, said Andy Hodgson. We offer carbon offset schemes to every client, yet the take up is quite low. The answer, he suggested, may be the introduction of legislation that creates parity, ensuring every operator is doing the same so it’s reflected in the pricing the consumer sees. SAF is the most exciting development, but the cost is high still. As an industry, we need to be calling on the commercial airlines to start introducing it more into their fleets to reduce the cost. Might governments subsidize SAF for airlines within that first few years of introduction?

What do the panelists want to see over the next 12 months?

Certainly, more corporate traffic. Coming into NBAA interest has been terrific and we have been inundated with requests, said Chris Clayton.

I’m hoping to see a little ease up on the ability to retain flight crew members, mechanics, quality employees, said Andrew Ladoceur. I'm hoping that we'll be able to staff with maintenance and pilots, with some quality people without the difficulties we're having today.

I want to see a boom in our banking sector and more flying, more aircraft available for charter, said Wendi. She cited that consolidation among the big groups and aircraft tied into fractional programmes has been frustrating.

In Europe we still haven't really seen a significant return of corporates, not to pre-Covid levels. The Far East market was slow to open back up post pandemic and the situation in Ukraine is limiting traffic heading eastbound. There are opportunities there, suggested Andy Hodgson. “If the preowned market levels off, we'll see more first-time buyers, which will bring more capacity into charter. The volume is great, but it’s all about the aircraft being profitable. The whole industry will benefit from that.”

![]() Video coverage of UAS' The Forward Discussion Charter Ops panel is available here

Video coverage of UAS' The Forward Discussion Charter Ops panel is available here

BlueSky Business Aviation News | 27th October 2022 | Issue #675