WINGX Global Market Tracker:

10% increase in UK bizjet activity reflects Champions League hosting

In Week 22 (27th May-2nd June), sixty-eight thousand global bizjet sectors were flown, 1% behind the previous week, down 1% compared to week 22 in 2023. Global Part 135 & 91K sectors fell 4% compared to Week 22 in 2023. Global bizjet sectors fell 1% in May compared to May 2023, 3% below May 2022.

These trends match with the YTD direction, all bizjet sectors down 1% compared to last year, according to WINGX`s weekly Global Market Tracker published today.

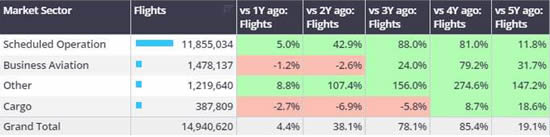

Scheduled passenger airline activity is 5% ahead of last year, whereas global cargo flight sectors have fallen 3% year on year.

1st January-31st May 2024, activity by sector. Business aviation = business jets only.

[click image to enlarge]

United States

In Week 22, bizjet activity fell 3% compared to the previous week (Week 21), 1% below Week 22 last year. Activity in Florida fell 5% compared to the previous week, but is running 3% ahead of Week 22 in 2023. Demand for bizjets in Texas was down on week 21, but 4% ahead of Week 22 2023 last year, and is trending up by 1% over the last 4 weeks.

Compared to the peak months back in 2022, bizjet activity in the US is 5% lower. Teterboro was an exception to the rest compared to 2022, with May seeing 0.5% gains on May 2 years ago. Palm Beach was 2nd busiest airport in the US for bizjet, but 14% less activity than in May 2022. Compared to 2019, Miami-Opa Locka outbound bizjet flights were up 108% in May 2024.

US airports ranked by bizjet departures, May 2024.

[click image to enlarge]

Super Midsize and Ultra Long-Range had their busiest May ever, sectors climbing 11% and 8% ahead of May 2023. Departures on Entry Level jets such as the Citation CJ1, are eroding, activity down 10% year on year, down 4% compared to May 2019. Private flight departments were the busiest operators of Very Light Jets in May, with 4,113 flights operated across the US, the busiest airport was McGhee Tyson in Tennessee.

Europe

In Week 22, European bizjet activity rose 6% compared week 21, with overall activity 2% ahead of Week 22 last year. Aircraft operating on operating certificates (AOC) saw flights fall 8% behind Week 22 in 2023. Charter flights out of France and Germany fell by 10% and 15% respectively, year-on-year.

Over the last 4 weeks, charter flights out of Germany are down by 17%.

For the whole of May 2024, bizjet activity in Europe ended May 1% ahead of May 2023, 10% below May 2022. Top 3 markets France, United Kingdom and Italy saw YOY growth. Italy and Greece had the busiest May in the last 5 years, both countries seeing strong growth YOY and vs May 5 years ago.

Germany and Austria weighed down the European trend, finishing May 10% and 5% down YOY, 10% and 2% behind 2019 respectively.

On June 1st Wembley Stadium in London hosted the final of the UEFA Champions League. Almost 200 additional bizjet arrivals were recorded into London airports across the Friday – Sunday weekend (31st May-June 2nd) compared to the previous weekend (24th-26th May). Biggin Hill appeared to benefit significantly from Champions League related traffic; during the weekend of the final an additional 68 bizjet arrivals were recorded compared to the previous weekend (in contrast London Luton saw just 6 extra arrivals).

Most arrivals into Biggin Hill during the Champions League final weekend came from France. In addition to the global audience, evidence of home support from Real Madrid and Borussia Dortmund fans was evidenced at Biggin Hill: 19 Arrivals were recorded from Spain, up from 7 the previous weekend, 16 arrivals from Germany, up from 3 from the previous weekend.

Bizjets parked at London Biggin Hill, pictured by Andy Patsalides.

Elsewhere last week Geneva airport (LSGG) played host to EBACE, 377 bizjet arrivals recorded during the calendar week of the event (27th May-2nd June), just 7 more arrivals than 22nd-28th May 2023 when EBACE was last held.

Rest of the World

In Week 22, bizjet activity in the Middle East fell 13% below Week 22 in 2023. For charter activity, week 22 saw a 20% slump in YOY flights out of the Middle East. There were 666 bizjet flights in Africa this week, 34% decline YOY, compared to 2,070 flights in Asia up 1% YOY. In South America bizjet activity is trending up by 11% in the last 4 weeks.

Just over 3,000 bizjet sectors were flown in Australia in May, 17% more than last year, 41% more than May 2022. China saw activity in May slump 17% compared to last year, although still well ahead of previous years. Activity in Saudi Arabia fell 32% year on year, contrast United Arab Emirates 5% ahead of May last year.

This weekend the hosting of the Canadian F1 Grand Prix is likely to see a bump a in bizjet activity at CYHU, CYMX, CYUL airports; last year the Grand Prix weekend saw average daily arrivals rise 1.5x higher than the daily average for the month of June.

Managing Director Richard Koe comments: “Global bizjet activity was flat in week 22, as it was for the month of May, and is trailing 2023 by just 1%, which very much reflects the mood at EBACE, tending towards normalisation after the turbulence of the post-Covid years.

"There is a good deal of underlying variability, with Europe a 7% above 2019, demand still hot in the Mediterranean, but tapering well below 2019 levels in Central Europe.”

"Global bizjet activity was flat in week 22, as it was for the month of May, and is trailing 2023 by just 1%, which very much reflects the mood at EBACE, tending towards normalisation after the turbulence of the post-Covid years.

"There is a good deal of underlying variability, with Europe a 7% above 2019, demand still hot in the Mediterranean, but tapering well below 2019 levels in Central Europe.”

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 6th June 2024 | Issue #751

| © BlueSky Business Aviation News Ltd 2008-2024 |