|

Business aviation declines slightly in first half of 2024, prompting prices to follow |

Nick Copley, president of SherpaReport, does the heavy lifting when it comes to defining what you need to know about access to business aviation, whether full ownership, fractional, jet cards or charters. This week he looks at demand for business aviation worldwide in the first six months of 2024 and what it’s doing to prices.

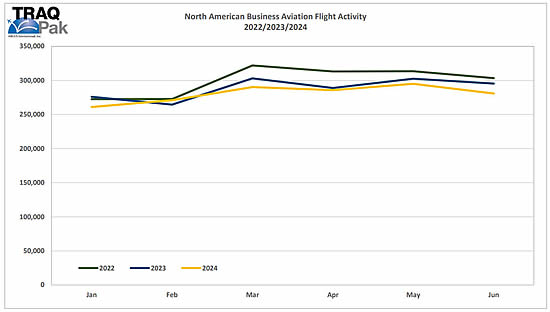

The latest numbers from aviation services company ARGUS show that global business aviation activity declined 1.6% globally during the first half of 2024, compared to a year earlier.

North American private flight activity saw a drop of 2.7% in the first six months of 2024, compared to the first half of 2023, while flight numbers were down 6.3% in Europe. It is important to highlight that the remaining regions around the world reported growth between January and June 2024. At these levels, the North American private flight activity will still be up 9.6% in 2024 from 2019 - the baseline pre-COVID year - but down from the record setting year of 2022.

For a sense of scale, however, there were 2,265,571 business aircraft departures globally in the first six months of 2024, with the United States responsible for 66.9% of those departures.

The analysts at ARGUS TRAQPak note “As we move through the second half of 2024, we expect the industry to remain mostly the same, with a slight improvement over the first half. We continue to remain in an environment that is stable but posting consistent slight declines.” Specifically, they expect flight numbers to decrease 1.1% between July to December 2024 over the same period in 2023, but to increase 3.0% compared to the first half of 2024.

With overall demand declining from peak levels and the number of pre-owned aircraft on the market increasing, prices are trending downwards, whether chartering, looking to buy a full aircraft or anything in between. For instance, on jet cards, prices have often dropped by a few hundred dollars an hour from the rates of a couple of years ago.

Fractional ownership increases

There have been consistent declines in the Part 135 charter market, and a declining Part 91 owner market but, on the flip side, a very strong Part 91k fractional market.

The large fractional operators all saw increased demand during the pandemic and built-up significant order books, with some long wait times for potential owners. These planes are being delivered, the fractional operators have grown their fleets, and the share owners are now flying. This has driven the flights in the fractional ownership segment up 12.4% in the first six months of 2024 compared to the first half of 2023.

Part 91 flight activity (owners) was down 5.5% over the same period and down 7.3% from 2022. Part 135 charter flight activity was down 5.2% from 2023 and 14.7% from 2022.

Among north American operators, fractional providers NetJets and Flexjet were once again the perennial one and two on the list and both saw growth of around 10%+ in their flight hours. Most other operators in the top 10 saw their flight hours increase as well, suggesting consolidation and movement from smaller operators to larger providers.

Looking at the aircraft by size (across charters, jet cards, fractional ownership and full ownership), the only category that saw an increase in flight numbers from January to June 2024 was mid-size jets, which were up 1%. All others - turboprops, small cabin and large cabin - saw drops of 3.5% to 5.9% over the first six months of 2023.

For 20 years, SherpaReport has been a comprehensive source for insider knowledge to help people make informed decisions about buying a private aircraft or investing in alternatives such as fractional ownership, jet cards and/or charters.