WINGX Global Market Tracker:

US market heats up as European bizjet demand slows post-Olympics

In Week 34 (19th–25th August), there were 70,242 business jet sectors flown globally, 1% more than Week 34 in 2023, according to WINGX`s weekly Global Market Tracker published today.

Week 34 was stronger than the last four-week YOY trend, which is 1% down, as is the year-to-date trend after almost 8 months. Part 135 & 91K bizjet activity saw a 4% lift compared to last year, with the last four-week trend 1% ahead of last year. Just under a quarter of bizjet flights in week 34 were flown by aircraft management fleets, fractional operators flew just over 13,000 sectors, 19% of all bizjet flights in week 34.

North America

In Week 34, there were 48,898 bizjet departures departing North American airports, 4% ahead of W34 in 2023. The dominant US market accounted for 46,947 North American departures, responsible for the region wide 4% year on year uplift. Across the busiest US States, Florida saw a 2% uplift compared to W34 in 2023, California and Texas both saw a 9% year on year increase.

Almost 13,000 bizjet departures departed across the 3 States, accounting for roughly 28% of all US W34 departures.

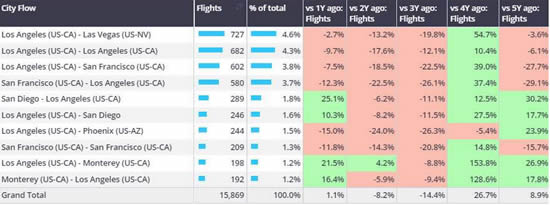

Despite the W34 uplift, US bizjet departures this month are 2% behind last year, still 24% ahead of 2019. California was busiest US State, with this week seeing a 9% bump YOY. Flights from San Diego to Los Angeles are up by 25% so far this month. Fractional fleets account for over a quarter of California bizjet departures, contrast Branded Charter departures which have fallen 15% behind August 5 years ago.

It was reported this week that Pilatus are set to open a new sales and service centre in Florida. So far this month, Pilatus aircraft account for 7% of all bizjets and turboprop departures out of Florida State. Both the PC-12 and PC-24 types are flying more than any August in the last 5 years, the PC-12 representing 90% of Pilatus activity out of Florida this month. In the Super Light Jet category, the PC-24 represents 9% of departures out of Florida this month, the Cessna Citation Excel dominates this segment in the State with a 72% market share.

US Bizjet city flows, departures out of California State, departing 1st-25th August 2024 vs previous years.

click images to enlarge

European Region

In Week 34 European bizjet activity dropped 3% compared to same week last year. The fourweek trend in Europe has now dropped to +2% compared to last year, demand normalising after the Olympics-related surge. August’s trends match the last 4- week trend, Olympics hosts France the top market, 7% year-on-year, growth. The UEFA EUROS uplift enjoyed in Germany was short lived, bizjet activity this month in decline compared to the last 5 years. The top 3 markets, France, Italy and the United Kingdom account for a 43% market share of all bizjet departures this month.

Nice (LFMN) is the busiest bizjet departure airport this August, activity on par with last year, 5% ahead of 2019. Le Bourget (LFPB) has seen just over 1,500 departures this month, a 34% jump compared to last year, appetite for the Olympic Games driving activity there.

Post Olympics the European summer appears to be a mixed bag of activity. Olbia for example, seeing the highest levels of bizjet arrivals in the last 5 years, contrast Naples, where bizjet arrivals are half what they were. Santorini and Mikonos have seen a large drop in bizjet arrivals compared to 5 years ago, departures to these airports from Athens (LGAV) have dropped by over 70% compared to August 2019.

Business Jet arrivals into select summer destinations, 1st–25th August 2024.

click image to enlarge

Europe wide, light jets are responsible for almost a quarter of bizjet activity this month. Super Midsize and Ultra-long-range jets are busier than any August in the last 5 years. Super Midsize activity on domestic Italian routes is running hot, busiest country international connection this month is France - United Kingdom.

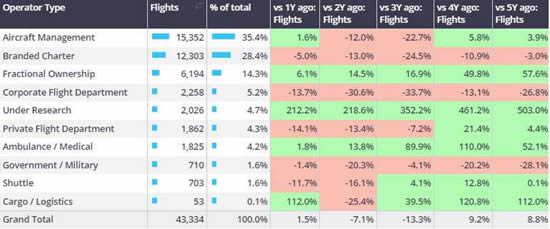

European Bizjet departures by operator type, 1st-25th August 2024.

click image to enlarge

Rest of the World

Outside of the US and Europe, the rest of the world saw a decline of 0.3% Week 34, with 11% growth in bizjet departures in Asia offset by steep drops in activity out of the Middle East and Africa. So far this month activity in the Middle East has dropped 6% compared to last year, Branded Charter sectors within the region dropping by almost a quarter compared to last year. Domestic bizjet activity in Saudi Arabia has more than halved compared to last year, contrast UAE domestic activity 31% ahead of last year. In Africa this month the decline appears to be coming from South Africa and Nigeria, bizjet departures down 22% and 69% YOY respectively.

Ultra long-range business jet departures by countries outside of United States and Europe.

click image to enlarge

Managing Director Richard Koe comments: “Part 135 and 91K flights out of Texas and Florida were up more than 10% in the latest week and are trending up 5% in August, contrast the 1% decline in bizjet activity in the US, 8 months into 2024.

"The late summer surge in the US compares to a post-Olympics slowdown in Europe, although Nice is still seeing strong growth, and there are record breaking levels of flight activity at Tivat in Montenegro.”

"Part 135 and 91K flights out of Texas and Florida were up more than 10% in the latest week and are trending up 5% in August, contrast the 1% decline in bizjet activity in the US, 8 months into 2024.

"The late summer surge in the US compares to a post-Olympics slowdown in Europe, although Nice is still seeing strong growth, and there are record breaking levels of flight activity at Tivat in Montenegro.”

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 29th August 2024 | Issue #761

| © BlueSky Business Aviation News Ltd 2008-2024 |