WINGX Global Market Tracker:

September slump in bizjet demand, notably in California

In Week 36 (2nd–8th September), there were 67,336 business jet sectors flown globally, 7% below Week 36 in 2023, according to WINGX`s weekly Global Market Tracker published today.

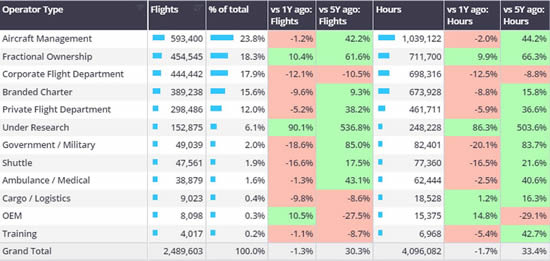

Part 135 & 91K activity fell 8% compared to Week 36 last year, with 34,485 sectors flown globally. Year to date (1st January-8th September), global bizjet activity is 1% below last year, 30% ahead of 5 years ago. Busiest global market the US, mirrors the global year on year trend, although departures are 27% ahead of 5 years ago. At the start of September (1st-8th), global bizjet activity has fallen 6% compared to last year.

Global business jet departures and hours trends, January 1st–September 8th 2024.

click image to enlarge

North America

In Week 36, there were 46,052 bizjet departures departing North American airports, 9% below the same week in 2023. There were 44,341 bizjet departures from the dominant US market, 9% below Week 36 in 2023. Florida, California and Texas all saw large declines in Week 36, following the regional trend. California saw a 15% drop in departures compared to Week 36 in 2023. Declines in Florida and Texas were less severe.

US Bizjet activity from January through to 8th September is 1% behind last year, 27% ahead of comparable 5 years ago. At the start of September, activity is slowing down, departures down 6% compared to the same 8 days in September 2023.

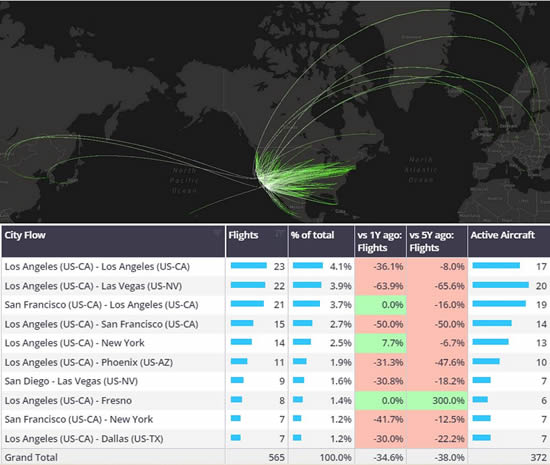

Three of the busiest 5 States this month are in decline, most notably California where departures have fallen 15% year on year. Most airports in California are seeing a decline in bizjet activity, notable declines at KSNA down 18% and KSFO down 27%. Over a quarter of activity out of California are Fractional fleets. Branded Charter and Corporate Flight Departments declining 21% and 35% vs last year. Corporate Flight activity has halved between Los Angeles and San Francisco compared to last September, Los Angeles to Las Vegas dropping by almost two thirds compared to last year.

Corporate Flight Departments, Bizjet city flows out of California, 1st–8th September 2024.

click image to enlarge

European Region

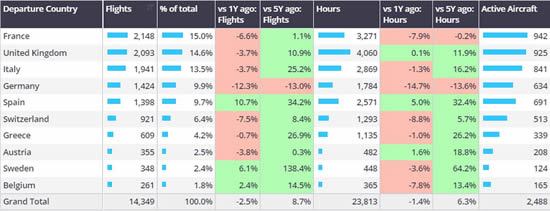

In Week 36, European bizjet activity dropped 2% compared to the same week last year, holding up better than the US weekly declines. In Week 36 there was significant downturn in the top European markets, France and Switzerland fell 7% compared to last year, Germany falling 12%.

Italy stood out against the regional downturn; 2% growth compared to Week 36 last year.

Year to date (1st January through 8th September), European bizjet activity has dropped 1% behind last year, so far in September the trend slowing down, activity now 3% behind September last year. Germany is seeing a large drop this month, activity 12% behind last year, 13% behind September 2019. Spain is well ahead of the regional trend, departures up 11% compared to last September, 34% ahead of 2019.

Business Jet departures by Country, 1st–8th September 2024.

click image to enlarge

Over a third of business jet departures out of Spain are on Aircraft Management fleets, activity 12% ahead of last September, contrast Corporate Flight Departments which are trending 15% below last year. Mallorca to London is the busiest city flow out of Spain this month, 41% more flights than last year. Branded Charter fleets are serving most of the activity on this route, the Phenom 300 flying the most flights.

Rest of the World

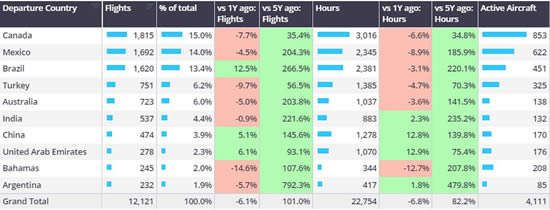

Outside of the US and Europe, the rest of the world saw large declines in Week 36. In Africa, bizjet activity fell 24% compared to Week 36 last year, Middle East down 11% and Asia down 7%. Bizjet activity outside of the US and Europe this year is 3% below last year, 6% below last year at the start of this month. Despite a slower start to the month than last year, Canada edges out as top ROW market with a 15% market share of departures. Despite the regional downturn there are pockets of growth, notably in Brazil, China and United Arab Emirates.

Business jet departures by country outside of US and Europe, 1st–8th September 2024.

click image to enlarge

Manging Director Richard Koe comments: “Bizjet demand has wobbled in September, significantly behind September last year, the slowdown mainly in the US, with bizjet cycles in California down 15% YOY.

"In Europe, both France and Germany saw big drops in demand this month.”

“Bizjet demand has wobbled in September, significantly behind September last year, the slowdown mainly in the US, with bizjet cycles in California down 15% YOY.

”In Europe, both France and Germany saw big drops in demand this month."

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 12th September 2024 | Issue #763

| © BlueSky Business Aviation News Ltd 2008-2024 |