Toronto, CanadaGlobal preowned twin-engine helicopter market faces headwindsTransactions down 30% YOY, prices soar to five-year high |

Aero Asset has released its 2024 Half Year Heli Market Trends Twin-Engine edition.

“Our analysis shows a 30% year-over-year decrease in retail sales volume of preowned twin-engine helicopters in the first half of 2024, and a 26% increase in supply for sale,” said Valerie Pereira, Vice President of Market Research. Additionally, Pereira explained the absorption rate had increased to 18 months of supply at current trade levels.

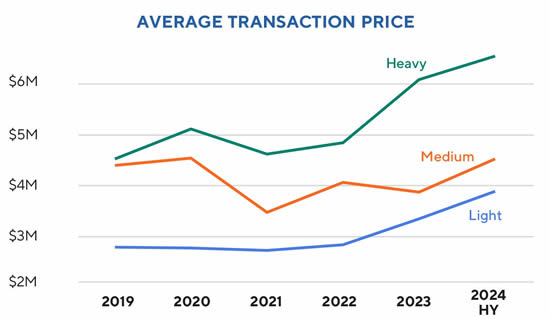

Pricing

Despite the lower sales volume, average preowned trading prices have reached a five-year peak across all twin-engine asset classes, with the biggest average transaction price increases in the light (+21%) and medium twin-engine helicopter markets (+14%) year over year (YOY).

Weight Class Performance

Retail sales declined across all weight classes YOY. The medium twin market saw the biggest drop in retail sales (-46% YOY), followed by heavies (-25% YOY), and light twin-engine helicopters (-14% YOY). Supply for sale of light twin-engine helicopters reached one of its highest levels; conversely, medium and heavy twin market supply for sale reached their lowest point in five years.

Regions

In the first half of 2024, Europe was the only region to buck the trend and see an increase in preowned retail transactions (+5% YOY). Asia Pacific experienced the biggest regional drop in retail sales volume (-73% YOY). Supply in North America and Europe increased by 5% and 35% respectively YOY. These regions represented 62% of the total supply and accounted for two-thirds of total retail sales in the first half of 2024.

Liquidity

The best performing preowned twin-engine market during the first six months of 2024 was the Airbus EC/H145, followed by the Airbus EC/H135, and the Leonardo AW139. The slowest performing preowned twin markets were the Airbus EC/H155 and Sikorsky S76D markets.

Visit aeroasset.com/report to download the latest report with all its data and valuable analysis. This year’s report includes a conversation with Sarah Fairweather, Partner and Head of Talent at Jaffa & Co.

![]()

BlueSky Business Aviation News | 26th September 2024 | Issue #765