WINGX Global Market Tracker:

Charter market hits an Autumn slump

In Week 38 (16th–22nd September), there were 72,821 global bizjet departures, 2% below Week 38 in 2023. Worldwide, Part 135 & 91K business jet sectors fell 3% compared to last year, according to WINGX`s weekly Global Market Tracker published today.

Year to date (1st January-22nd September), just over 2.6 million bizjet flights have been operated, 1% below comparable 2023. September’s month to date trend (1st–22nd) is now 5% below September last year, up from -7% during the 1st–15th September period.

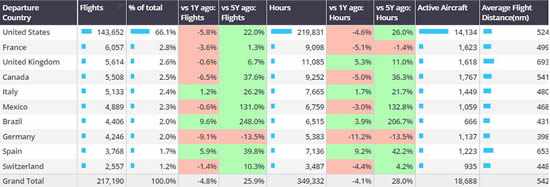

Global business jet departures and hours trends by country, September 1st–22nd 2024.

click image to enlarge

North America

In Week 38, there were 51,201 bizjet departures departing North American airports, 3% below Week 38 in 2023, the United States matching this trend. California saw 7% declines compared to Week 38 last year, Florida held up slightly better, trending 5% below last year, Texas down 1% compared to W38 last year.

So far this month US bizjet activity is 6% behind last year, although 22% ahead of September 5 years ago. California seeing activity 1% behind 2019, 11% behind last year.

Part 135 activity in the US has dropped significantly this month, departures from 1st to 22nd September dropping 10% behind comparable last year. California is seeing the most significant drop-in activity, sectors 16% behind last year, 11% behind September 2019. Wheels UP jet fleet has seen a 39% drop-in activity compared to September last year, Vista Jet and associated subsidiaries 17% behind last September.

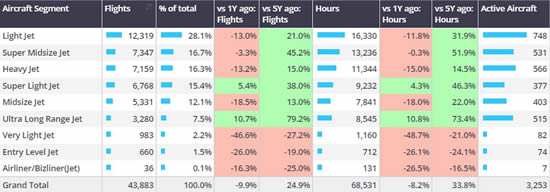

There are pockets of growth across the aircraft segments, Super Light and Ultra Long-Range Jets with year-on-year growth.

Part 135 Bizjet aircraft segments, departures from US airports, 1st–22nd September 2024.

click image to enlarge

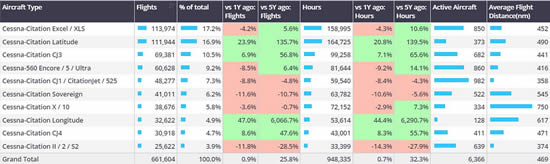

It was reported this week that workers at Textron Aviation’s Wichita factories are on strike. The company manufactures Cessna aircraft, so far this year there are 6,366 active Cessna bizjets flying in the US. Departures of Cessna bizjets are 1% ahead of last year, 26% ahead of 2019, so far this month Cessna bizjets had more than a third of market share of US bizjet departures.

Busiest Cessna bizjet types, 1st January - 22nd September 2024.

click image to enlarge

European Region

In Week 38, European bizjet activity dropped 2% compared to the same week last year. Activity in the UK and France was on par with W38 last year, Switzerland and Italy pockets of growth, contrast Germany where sectors dropped 11% compared to W38 YOY. Year to date (1st January-22nd September), activity has fallen 1% compared to last year, Germany and Austria are notable markets behind 2019.

This month European bizjet activity has fallen 3% compared to September last year, holding 7% ahead of September 2019. Despite the regional downturn, Italy, Spain and Greece are seeing growth compared to last year. In Italy, bizjet departures from Olbia (LIEO) are trending 11% ahead of last year, top connection from Olbia is Milan Linate, followed by Nice and Geneva.

The Monaco Yacht Show takes place this week (25th–28th September), arrivals into nearby Nice airport (LFMN) this month, are 11% ahead of last year. Over the weekend prior to the event (20th–22nd), 184 bizjet arrivals were recorded, most arriving from Le Bourget (LFPB). As the show gets underway this week arrivals are expected to rise, during the 2023 edition of the show (27th–30th September) average daily arrivals into LFMN during the event were 39% higher than the average daily arrivals for September 2023.

Business Jet country flows, Europe, 1st–22nd September 2024.

click image to enlarge

Rest of the World

Outside of the US and Europe, the rest of the world saw small year on year growth in Week 38.

The Middle East is the exception, where sectors dropped 5% year on year in Week 38. So far this month the region is 13% behind last year, Saudi Arabia bizjet activity remains well below last year and September 2019. Elsewhere, Africa saw activity rise 7% compared to W38 last year, Asia up 3% and South America up 9%.

Managing Director Richard Koe comments: “Business jet demand is ebbing fast this month, particularly in the small and midsize fleets. In the US, the weakest spot is California.

"In Europe, the post Olympics hangover is showing up in much lower flight activity, notably in Germany where flight activity is trending down by 9% this month.”

“Business jet demand is ebbing fast this month, particularly in the small and midsize fleets. In the US, the weakest spot is California.

"In Europe, the post Olympics hangover is showing up in much lower flight activity, notably in Germany where flight activity is trending down by 9% this month.”

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 26th September 2024 | Issue #765

| © BlueSky Business Aviation News Ltd 2008-2024 |