WINGX Global Market Tracker:

| Florida bizjet bounced back in Week 40, now bracing for Milton impact in Week 41 |

In Week 40 (30th September–6th October), there were 70,878 global business jet departures, 3% fewer than Week 39, and 4% fewer than Week 40 in 2023, according to WINGX`s weekly Global Market Tracker published today.

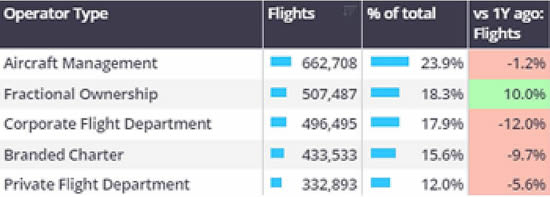

The global 4-week business jet trend is 4% down on last year, significantly worse than the year-to-date 2% decline. By operator types, Management Fleets have the most activity, holding stead YOY; whilst Corporate and Charter operations are stalling, Fractional fleet activity still soaring ahead, 18% of all sectors flown, and 10% up on last year.

Global business jet departures by operator type, January 1st–October 6th 2024.

click image to enlarge

North America

In Week 40, there were 50,827 bizjet departures departing North American airports, 2% below W40 in 2023. Two weeks ago saw a double-digit drop in flight activity in Florida, buffeted by Hurricane Helene. In the most recent week, flights jumped back up by 25% on a sequential basis, though still 3% behind the same week last year. The impact of incoming Hurricane Milton will inevitably subdue that recovery in Week 41.

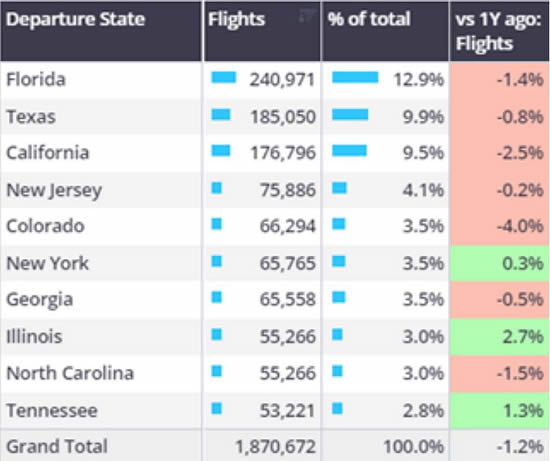

Other leading US States have seen demand in the doldrums in the last few weeks: bizjet flights from California were down 5% in Week 40 and falling 6% in the last 4 weeks, with a Year to Date decline of 3%. Texas has trended flat compared to last year, though dipping by 4% in the most recent week. A few US States are still seeing some growth in bizjet activity this year, noting New York, Illinois and Tennessee. And whilst bizjet activity in Florida is off its peaks this year, outbound flights are still running over 50% ahead of comparative 2019 levels.

United States bizjet departures 1st January-6th October 2024.

click image to enlarge

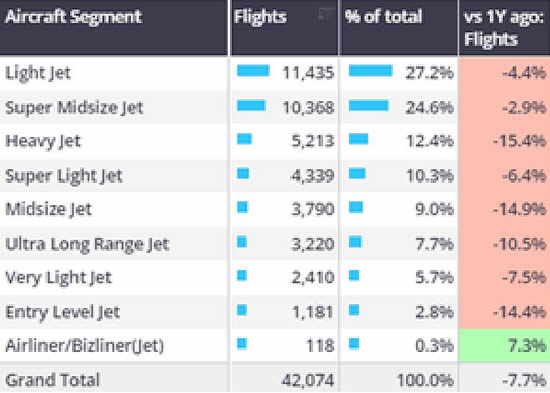

In terms of cabin performance and aircraft type, the opening few days of October have seen declines in almost all segments. Super Midsize and Light Jet demand has been relatively resilient. The most significant slowdown has been in the larger aircraft, with Heavy Jet traffic down by 15%.

Ultra Long Range flights, up more than 50% compared to 2019, was down by 10% in the last few days.

Bizjet segments, US departures, 1st–6th October 2024.

click image to enlarge

European Region

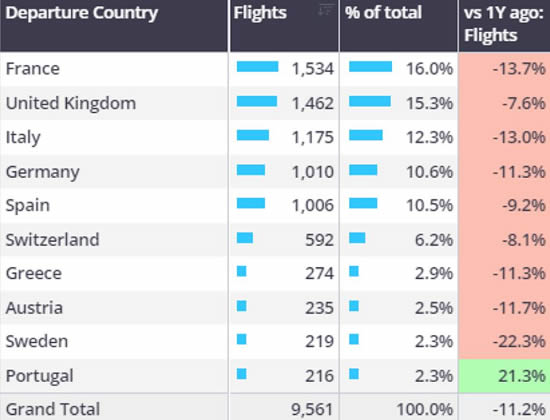

European bizjet activity fell 4% compared to Week 40 last year, dropping 8% compared to Week 39. Departures from the United Kingdom fell 7% compared to Week 40 last year, well below the 4-week trend which is still on par with last year. Germany recorded a 5% decline compared to last year, in line with the 4-week trend of -6%. Activity in Switzerland rose 4% compared to Week 40 last year, lifting the 4-week trend to 1% ahead of last year.

Despite October’s slow start - the first 6 days’ traffic is 11% short of last year’s same dates - the 2024 year-to-date trend remains healthy, activity just 1% below last year, 6% ahead of 5 years ago. So far this month, France and the UK, which represent 31% of market activity, are behind last year and comparable 5 years ago. Portugal is an outlier, departures 21% ahead of last October, 61% ahead of 5 years ago.

European bizjet markets, 1st–6th October 2024.

click image to enlarge

Rest of the World

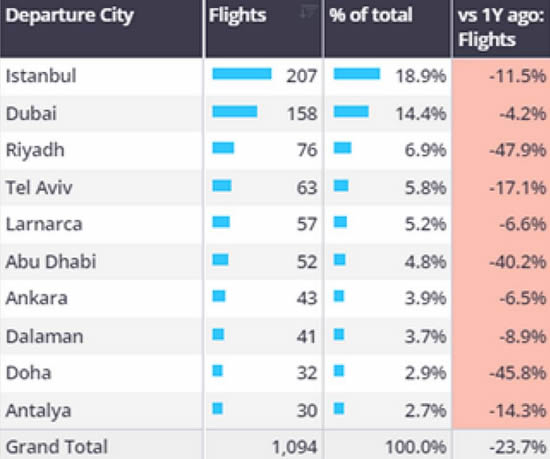

Outside the principal North American and European markets, activity in the rest of world saw sizeable declines in Week 40. In the Middle East, widescale conflict is clearly subduing bizjet demand, with Week 40 activity fell 22% compared to last year, the 4-week trend falling 15% behind last year.

So far this month, just over 1,000 bizjet departures have been recorded out of Middle East airports, 24% below the first 6 days of October last year. Departures out of Saudi Arabia have fallen 59% compared to last October, 37% below 5 years ago. Qatar is also seeing heavy declines compared to last year, a 41% decline in departures, although well ahead of last year. Israel has seen activity fall 8% year on year, 13% declines compared to 5 years ago.

Business jet departures from Middle Eastern cities, 1st–6th October 2024.

click image to enlarge

Managing Director Richard Koe comments: “Business jet demand is navigating turbulent waters, with the approach of the US elections, outgoing and incoming hurricanes across the South-East of the country, economic stagnation in Europe and escalating conflicts in the Middle East.

"The combined headwinds are clearly widening the declines in comparison to 2023, which itself was a reset from the post-Covid high points in 2022.”

“Business jet demand is navigating turbulent waters, with the approach of the US elections, outgoing and incoming hurricanes across the South-East of the country, economic stagnation in Europe and escalating conflicts in the Middle East.

"The combined headwinds are clearly widening the declines in comparison to 2023, which itself was a reset from the post-Covid high points in 2022.”

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 10th October 2024 | Issue #767

| © BlueSky Business Aviation News Ltd 2008-2024 |