WINGX Global Market Tracker:

Business jet activity rebounds in 3rd week of October

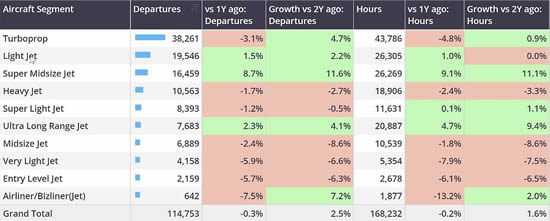

In Week 42 (14th to 20th of October), there were 114,753 business jet and turboprops flights operated globally, 0.3% fewer than the same days last year, 2.5% up from last year, according to WINGX`s weekly Global Market Tracker published today.

Only three business jet segments have seen an increase in activity year-on-year, with outsized gains for Super Midsize aircraft missions, 16,459 sectors, and increase of 8.7% YOY, 12% up on two years ago. Other segments saw diminished activity this week, notably Entry Level, Very Light Jets and Bizliners.

The week 42 trend is stronger than month-to-date, with business aviation sectors trending down 3% on October 2023. Year-to-date, global turboprop activity is down by 3%, business jet sectors down by 2%.

Global business aviation segment activity in Week 42 YOY.

click image to enlarge

North America

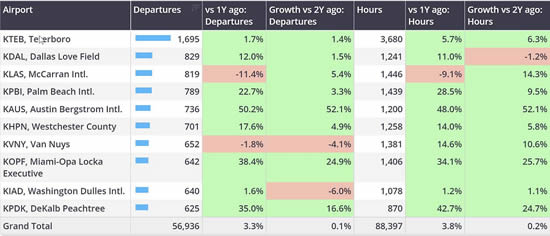

Week 42 saw 83,227 business aviation sectors flown from airports in North America, of which 32% were props, with an overall increase of 1.6%. It was a particularly strong week for Super Mid, with 13,940 missions up by 9% on the same week last year. Light Jet activity was also well up, 3.6% on week 42 last year, a rebound from 2% declines in the first half of the month. Overall, activity is still recovering from the hurricane-afflicted start to the month, with trends now at 1.8% down on October 2023. Year to date, North America´s business jet activity is down 2.2% compared to last year, with a 4% drop-in prop activity weighing against 8% and 6% gains in Super Mid and Ultra Long Range jet sectors.

By airport, and including only business jet platforms, the busiest locations had some large gains in Week 42, most notably Grand Prix host Austin, flights up 50% YOY. DeKalb Peachtree also saw a big lift, movements up by 35% versus same week last year. McCarran Las Vegas saw a substantial drop, 11% fewer bizjet visits. Palm Beach posted another all-time high, with 22% growth vs 2023 and 3% increase on 2022. Of these airports, only Peachtree, Teterboro and Westchester are up month-to-date, and for the year-to-date, just Dulles and Westchester, with Scottsdale also included and growing in the top 10. Compared to 2022 YTD, Palm Beach activity is down 10%.

Business jet activity at top US airports in Week 42.

click image to enlarge

Europe

There were 11,131 bizjet operations in Europe in Week 42, down by 0.7% compared to same dates in 2023, down 2.2% versus 2022. Fractional ownership activity was up, setting a new record high, plus 7% versus last year, 15% up versus 2022.

The Charter market weakened by 6%. The top 3 countries are all seeing weaker demand, notably France and Germany where flight operations are dipping below 2019 levels. As has been the case since Covid, the Med markets in Italy, Spain, Turkey continued to see more bizjet activity. There is a good deal of variance at airport level, with Le Bourget up 8%, London Luton up 13%, whereas Farnborough and Nice were both down 12%. Ataturk airport saw a 33% increase in bizjet operations in Week 42.

Business jet activity in Europe in Week 42 by country.

click image to enlarge

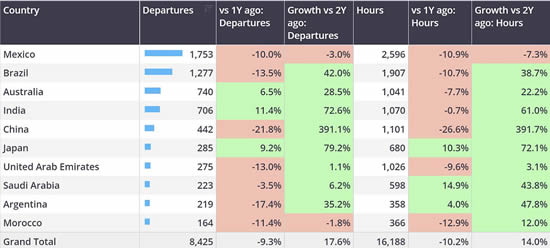

Rest of the World

Outside North America and Europe, there were 8,425 bizjet departures in Week 42, slipping 9% compared to same days last year, although 18% up on two years ago. Australia, India and Japan gained activity, offset by substantial drops in flights from airports in Mexico, Brazil and China.

The UAE also saw a sharp drop in flights this week, whereas Saudi Arabia´s 3% fall in departures compares favourably to more than 20% decline in flights since the start of the year. Since January,

Mexico is the busiest market by some way, though with declines of 4%, with next largest markets Brazil and Australia both seeing buoyant growth in bizjet operations so far this year.

Bizjet activity in countries outside Europe and North America.

click image to enlarge

Managing Director Richard Koe comments: “Business jet activity picked up this week, with the US seeing the first positive year-on-year numbers since the summer, even the charter market looking up. The Austin Grand Prix provided a significant lift. In Europe, the big three markets saw bizjet activity slide, appearing to correlate with a darkening economic outlook.

"Southern Europe is still seeing strong demand, in contrast to much weaker levels of operation in the Middle East.”

“Business jet activity picked up this week, with the US seeing the first positive year-on-year numbers since the summer, even the charter market looking up.

"The Austin Grand Prix provided a significant lift. In Europe, the big three markets saw bizjet activity slide, appearing to correlate with a darkening economic outlook.

"Southern Europe is still seeing strong demand, in contrast to much weaker levels of operation in the Middle East.”

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 24th October 2024 | Issue #769

| © BlueSky Business Aviation News Ltd 2008-2024 |