WINGX Global Market Tracker:

Bizjet demand slack post US election

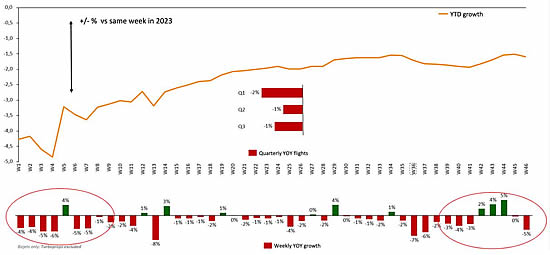

In Week 46, (11th-17th November), there were 72,358 business jet departures globally, 5% fewer than W46 in 2023, dragging the four-week trend down to just 1% ahead of last year, according to WINGX weekly Global Market Tracker published today.

For 2024, to-date, global business jet activity remains at 1% below last year.

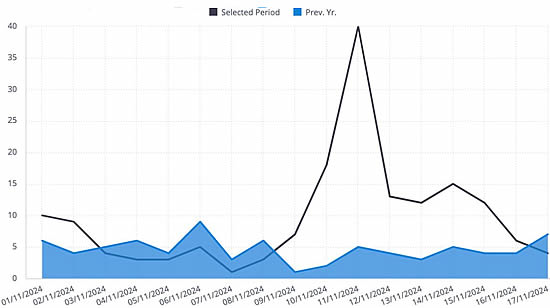

Global business jet departures by week in 2024.

click image to enlarge

North America

Post US election, bizjet activity in the United States has steadily fallen. In Week 46 (11th-17th November), bizjet activity fell 7% compared to W46 in 2023, marking an end of 4 weeks of year-on-year weekly growth. The four-week trend in the US is now just 1% ahead of comparable last year.

12 days post-election (5th-17th November), 93,823 bizjet flights have departed US airports, 3% fewer than comparable last year, and over 34,000 more departures compared to the Covid era 2020 election (November 3rd-15th 2020). Twelve days post 2020 election, departures were 22% below pre-Covid November 2019. This year, post-election, fractional activity remains robust, corporate flying remains behind last year.

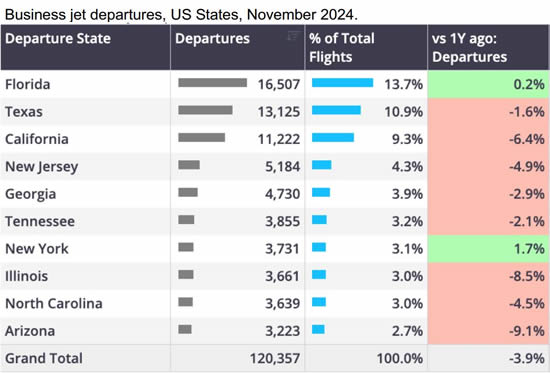

Business jet departures, US States, November 2024.

click image to enlarge

US bizjet activity has slowed down in November, departures 4% behind November last year. There are pockets of growth in Florida and New York State, bucking the country wide decline. California has seen activity fall 6% so far this month. There’s a distinct lack of activity on the State’s busiest city pair, Los Angeles - Las Vegas, departures down 16% compared to last year. Intra LA activity has fallen by 17%, flights from LA to Phoenix falling by over a quarter.

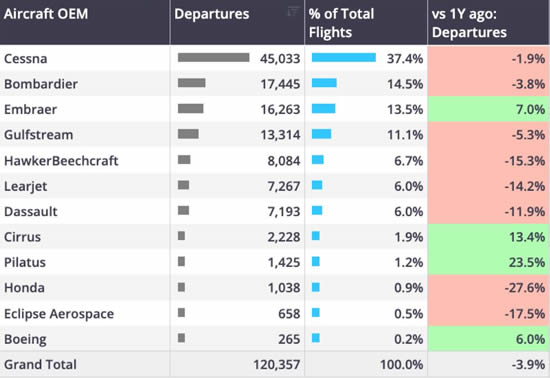

US Business jet departures by OEM in November 2024.

click image to enlarge

Europe

In Europe, bizjet activity was on par with Week 46 in 2024, the four-week trend now +2%, the year-todate trend remains at -1%. Bizjet activity in W46 rebounded 3% compared to W46 last year in the UK, matching the 4-week trend.

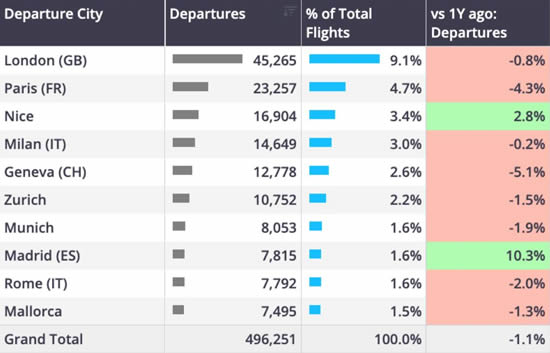

Germany’s bizjet woes continued, W46 activity declined 3% compared to W46 last year, the last 4-week trend 4% below last year. This year, top market France has seen activity in 2% decline compared to last year, 2nd ranked UK on par with last year. Just Nice and Madrid have seen growth so far this year, all other top cities in decline compared to 2023.

So far this month, activity in Europe is on par with November 2023, small growth amongst most of the top markets, however, declines in Germany and Austria are responsible for the region-wide stagnation.

European bizjet departures by city, January through November 2024.

click image to enlarge

Rest of the World

Bizjet activity in the Middle East was on par with Week 46 last year, the four-week trend returning to be on par with last year. Activity in Africa remains consistent, even if well down on last year; in Week 46 the declines matched the previous week, down 22% year on year, the four-week trend is -13%.

Political events in the rest of world region are causing localised uplifts in bizjet activity. Rio de Janeiro hosts the G20 summit this week (18th & 19th November), on the day before the event (17th November) 25 bizjet arrivals were recorded at SBGL, SBRJ and SBJR airports, up from 17 on the 16th. Last year’s event was held in New Delhi in September, VIDP airport in New Delhi recorded 29 arrivals on the day before the G20 started, 15 more than the average daily arrivals for the month of September. Elsewhere the hosting of the COP29 climate conference in Baku is having a profound effect on bizjet activity at UBBB airport.

Chart 5 highlights the large spike in arrivals around the conference start date (11th November), 40 recorded bizjet arrivals its peak, for context that’s almost a quarter of the number of arrivals recorded in the whole of October this year.

Daily bizjet arrivals into Baku, (UBBB airport) November 2024.

click image to enlarge

Managing Director Richard Koe comments: “In contrast to surveyed industry sentiment, which is apparently buoyant following Trump’s election triumph, bizjet flight activity in the US has actually slackened in the last two weeks.

"Elsewhere in the world, big political gatherings in Baku and Rio attracted a relative local spike in bizjet usage.”

“In contrast to surveyed industry sentiment, which is apparently buoyant following Trump’s election triumph, bizjet flight activity in the US has actually slackened in the last two weeks.

"Elsewhere in the world, big political gatherings in Baku and Rio attracted a relative local spike in bizjet usage.”

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 21st November 2024 | Issue #773

| © BlueSky Business Aviation News Ltd 2008-2024 |