WINGX Global Market Tracker:

Year-end bumps up bizjet activity

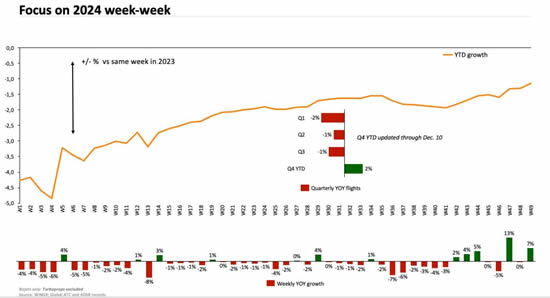

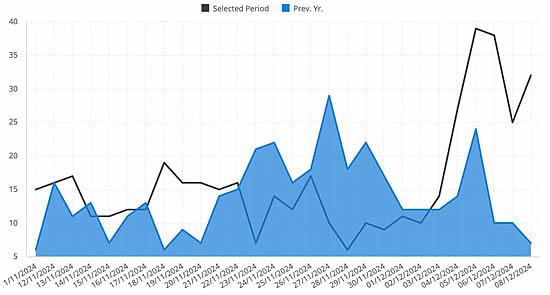

In Week 49 of 2024 (2nd-8th December), almost 74,000 bizjet departures were recorded globally, 7% more than W49 last year, inflating the four-week trend to +3%, according to WINGX weekly Global Market Tracker published today.

Global Part 135 & 91K activity jumped 11% compared to W49 in 2023, moving the 4-week trend to +5%. Globally, the year-to-date trend through December 8th is still 1% below last year, but compared to December 2023, worldwide bizjet movements are up by 9%.

Global business jet departures by week, 2024.

click image to enlarge

North America

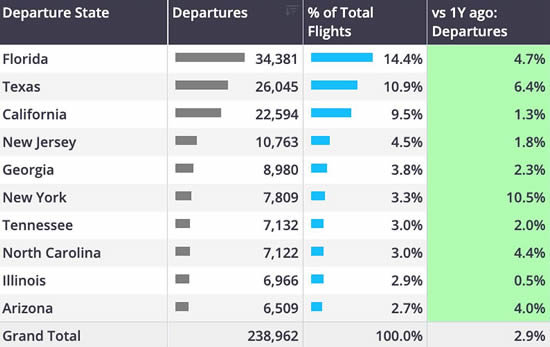

Bizjet activity in North America rose 10% compared to Week 49 in 2023, a 14% increase compared to the previous week. The US-wide four-week trend is now 5% ahead of comparable last year, Florida matches this, California is at +3% and Texas at +8%.

Specifically in the US, Florida was the busiest departure State in week 49, representing 15% market share of US wide departures. All the busiest States saw year on year growth, notably California where an additional 400 departures were recorded compared to week 48, and a 14% increase YOY. The growth is all coming from Part 135 and 91K activity, up 20% in California.

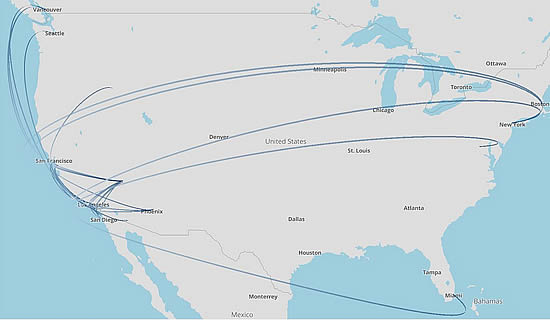

NetJets enjoyed an 18% market share of bizjet activity out of California, flying almost 600 more departures than second busiest operator Flexjet. There was a significant rise in bizjet activity between Los Angeles and San Francisco, 245 recorded departures. NetJets was the busiest operator on the LA-SF route, accounting for 22% market share. Over a quarter of flights on the route were flown by Heavy Jets, next busiest were Super Midsize types.

Top business jet routes from California, W49 2024.

click images to enlarge

Post US-election, bizjet activity is 3% ahead of comparable last year, notably gains in Florida, Texas and New York State. Post election Aircraft management fleets are busiest. Fractional fleets are flying 12% more than during the comparable period last year, corporate activity lagging by 14%.

Post US-election business jet departures by US State (6th November-8th December).

click image to enlarge

Europe

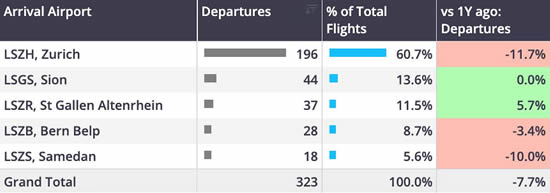

In Europe, bizjet activity in W49 fell 4% compared to W49 in 2023. Germany recorded a 13% drop in flights compared to early December last year, stead from the previous week. Despite year-on-year declines, Switzerland saw the usual seasonal spike as the ski season begins, notable across the airports serving top Alpine resorts.

Bizjet arrivals into select airports serving Swiss ski resorts during Week 49 2024 (note trends vs same dates).

click image to enlarge

In Week 49 Sion and St Gallen airports recorded a small amount of growth compared to last year, consistent with the last 12 months of activity at those airports. December – March are the busiest months, with February seeing peak activity. There is an overwhelming bias towards weekend traffic, Sunday’s seeing peak activity at the two airports. Over the last 12 months aircraft management fleets have operated 40% of bizjet flights into Sion and St Gallen airports, fractional and branded charter jointly responsible for 45% of arrivals. Most arrivals in the last 12 months came from France, Germany the top aircraft registration.

Rest of the World

Outside of Europe and the United States, bizjet activity in W49 was on par with W49 in 2023. Activity in the Middle East saw a 14% rebound compared to the previous week, representing a 1% gain over W49 last year. Activity in the Middle East is largely being lifted by the hosting of the Abu Dhabi F1 Grand Prix between December 6th-8th. Chart 5 (below) highlights the increase in activity in the run up to the hosting of the Grand Prix, arrivals peaking just ahead of the start of the Grand Prix weekend. During the event weekend (6th-8th December), 95 bizjet arrivals were recorded, 16 of which came from other airports in the UAE.

The United Kingdom was the top international origin during the race weekend, followed by Qatar and India, branded charter and aircraft management fleets responsible for over half of arrivals during the race weekend.

Elsewhere in the ROW region, activity in in Africa in W49 fell 19% compared to W49 2023, in Asia activity grew 5%, whereas in South America activity grew 2%. Bizjet activity in Brazil is up by 11% this year.

Bizjet arrivals into Abu Dhabi airports over the last 4 weeks, highlighting build up prior to F1 Grand Prix event.

click image to enlarge

Managing Director Richard Koe comments: “The post-election bounce continues, with week 47 seeing the largest YOY increase in flight activity so far this year, closing almost all the deficit accumulated earlier this year. California has seen an especially strong recovery.

"In Europe, demand is sagging in leading markets, with Italy the year-long exception. Bizjet demand in South America continues to thrive.”

“The post-election bounce continues, with week 47 seeing the largest YOY increase in flight activity so far this year, closing almost all the deficit accumulated earlier this year. California has seen an especially strong recovery.

"In Europe, demand is sagging in leading markets, with Italy the year-long exception. Bizjet demand in South America continues to thrive.”

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 12th December 2024 | Issue #776

| © BlueSky Business Aviation News Ltd 2008-2024 |