WINGX Global Market Tracker:

Bizjet demand is up despite economic concerns

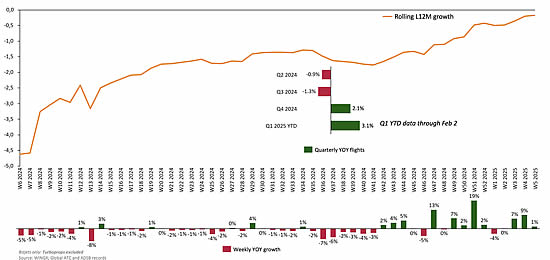

Bizjet activity in terms of departures in Week 5 (January 27th-2nd February) was 1% ahead of last year, global Part135 and 91K activity was 5% ahead of last year, according to WINGX's weekly Global Market Tracker published today.

So far this year (1st January-2rd February), global business jet flights are 3% ahead of last year, flying hours are also 3% ahead of last year.

YOY week-week view of global bizjet flights since Jan 2024.

click image to enlarge

United States

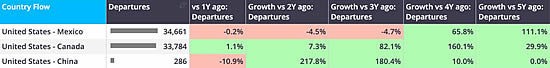

So far this year, activity in the United States is 5% ahead of last year in terms of both departures and flight hours. Over 90% of departures this year have been domestic US flights, domestic activity 5% ahead of last year. Top international connection this year is to Mexico, activity 1% ahead of last year, 2nd busiest international route is Canada, departures 2% ahead of last year, activity to several Caribbean islands well ahead of last year, Turks and Caicos the exception. Just 18 bizjet flights from the US to China this year, 36% fewer than last year.

Bizjet departures from United States to Canada, China and Mexico, full year 2024 vs previous years.

click image to enlarge

In the wake of Trump’s tariffs launched in Week 5, it’s worth noting the volume of US bizjet connections with Canada, China and Mexico. Last year Mexico and Canada were the busiest international connections for bizjet departures out of the US, connections to Canada growing each year since pre-pandemic 2019. In 2024, bizjet connections with China were on par with 2019, in decline compared to 2023.

Week 5 (27th January-2nd February) activity in the US saw a 1% increase in bizjet activity compared to last year, Part 91K and 135 activity 5% ahead of last year. In Texas, activity was 6% ahead of last year, largely driven by increases in intra-State activity between Dallas-Houston and Austin-Dallas. Across the State, Branded Charter activity was up on last year, Wheels Up Private Jets and Jet-Ten notable operators.

NetJets vs Flexjet, business jet departures, hours and active aircraft in 2024 vs 2019.

click image to enlarge

So far this year, Fractional operators in the US are flying 13% more departures and flight hours than last year, the active fleet 6% ahead of last year. Major fractional operator Flexjet announced this week a 182 aircraft order with Embraer. Last year, Flexjet flew 154,000 departures globally, more than 100% growth compared to 2019. The active fleet in 2024 reached 325 aircraft, 78% more than 2019.

The comparisons with NetJets draw closer when looking at average hours per tail sign, in 2024 NetJets flew on average 669 hours per tail sign, Flexjet 782. In 2024 NetJets average sector length was 552nm, Flexjet 578nm.

Europe

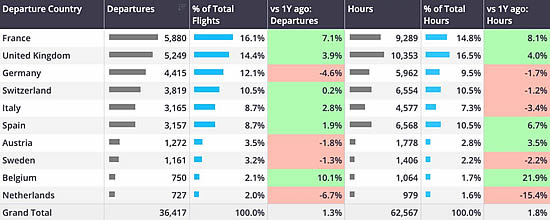

Just under 36,500 bizjet departures have been flown in Europe so far this year, 1% more than last year. The active fleet is just 9 aircraft ahead of last year, flight hours up 2%. In Week 5, bizjet activity in `Europe was 4% ahead of last year; UK, France and Switzerland recording strong growth.

France is the busiest market so far this month, in week 5, strong activity on routes from Paris - London, Nice - London and Paris - Milan.

Activity in Switzerland is on par with last year, although 6% growth in activity in Week 5, strong growth in bizjet arrivals in St Gallen, Payerne Air Base and Lugano airports.

Germany is ranked 3rd in terms of bizjet departures so far this year, although activity lagging 5% behind last year. The active fleet in Germany is 1% behind last year, the active number of aircraft flying globally on the German (D) registry has fallen 11% compared to last year, flight hours down 5%.

Business jet departures, European countries, 1st January - 2nd February 2025.

click image to enlarge

Rest of the World

Activity outside of the United States and Europe so far this year is 1% below last year, average hours per tail sign falling 4% compared to last year. Private and Branded charter activity is ahead of last year, Corporate flight departments flying 15% less than last year.

In Week 5, ROW activity was 3% ahead of last year. Departures in the Middle East 9% ahead of W5 last year, Africa up 6%, South America up 2%, Asia fell 2%.

Managing Dirfector Richard Koe comments: “Economic concerns are up this week in the wake of Trump's trade war declaration. This will certainly worry bizjet OEMs outside the US, although, as a proportion of total activity, international flights to and from the US are a very small part.

"And flight demand is still seeing the positive effects of the Trump bump, with fractional demand particularly strong, endorsing Flexjet's bumper billion-dollar new aircraft order this week."

“Economic concerns are up this week in the wake of Trump's trade war declaration. This will certainly worry bizjet OEMs outside the US, although, as a proportion of total activity, international flights to and from the US are a very small part.

"And flight demand is still seeing the positive effects of the Trump bump, with fractional demand particularly strong, endorsing Flexjet's bumper billion-dollar new aircraft order this week."

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 6th February 2025 | Issue #782

Add BlueSky to your marketing mix in 2025!

Unbeatable ad rates | Request our rate card here

| © BlueSky Business Aviation News Ltd 2008-2025 |