WINGX Global Market Tracker:

US market stays strong, activity slumps in Germany, soars in Africa

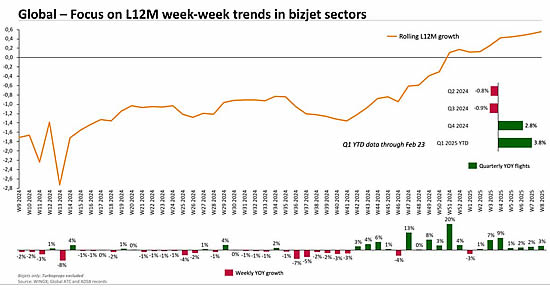

According to WINGX`s weekly Global Market Tracker published today, 74,530 business jet departures were recorded worldwide in week 8 (17th-23rd February), 3% more than W8 last year, 4% down from the last rolling 52 week high of 77,678 departures recorded in W42 of 2024.

Part 135 and 91K sectors stretched 8% ahead of W8 last year, matching the yearto-date trend, although still 3,332 departures short of the last rolling 52 week high in Week 29 of 2024.

Year-to-date NetJets has flown a quarter of Part 135&91K departures, up from 24% market share of Part 135&91k departures in 2024.

YOY week-week view of global bizjet flights.

click image to enlarge

United States

US business jet activity in Week 8 rose 2% compared to last year, Part 135 & 91K sectors 8% ahead of last year. Florida saw 4% gains on last year, California and Texas saw 6% gains on Week 8 last year.

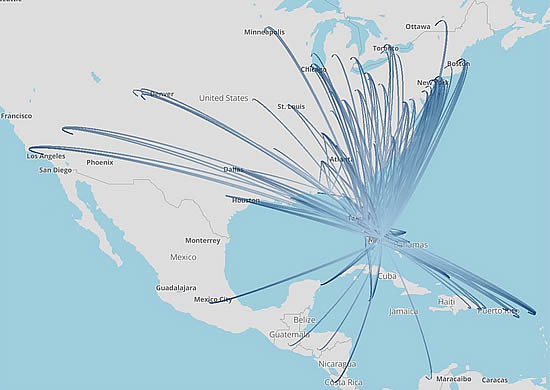

Bizjet city flows out of Florida, 1st January - 23rd February 2025.

click images to enlarge

So far this year Florida is a hotbed of bizjet activity, 17% of all bizjet departures from the United States this year originating from the Sunshine State. Florida bizjet activity is up 7% compared to last year, ahead of the US-wide trend of +4%. Fractional operators have increased their flight activity by 13% compared to last year and now account for 24% of business jet departures from Florida this year.

Whilst a smaller market share, Branded Charter operators are matching Fractional fleets year-on-year growth. Corporate Flight Departments in Florida are not immune to the US-wide downturn, Corporate fleets flying 12% fewer departures out of the State, equalling the US-wide trend.

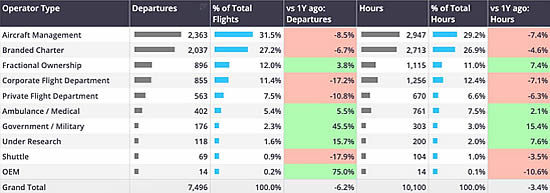

Post-US election (November 6th 2024-February 23rd 2025) bizjet departures, flight hours and potential fuel uplift.

click image to enlarge

Post-US election flying looks robust, bizjet departures since November 6th 2024 are 5% ahead of comparable last year. Bizjet departures out of all major US States are ahead of comparable last year since the election, Florida and Texas up 6%, New York 10% ahead. Fractional operators are flying 14% more than comparable last year since the election, contrast Corporate flight departments, flying 11% less than last year.

European Region

In Week 8, European bizjet activity rose 4% compared to last year, ahead of the four-week trend which is now on par with last year. The UK saw 9% gains on last year, the likely afterglow of school holidays and traffic bound for ski resorts in Week 7. Switzerland saw a 21% increase in bizjet activity in Week 8, well ahead of the year-to-date trend of +1%. Airports near popular ski resorts saw an increase in arrivals, notably Samedan, with over 50 more arrivals in Week 8 compared to Week 7.

Elsewhere in Week 8, departures out of Germany fell 10% compared to last year, the four-week trend now 8% behind last year. Year to date, bizjet sectors in Germany have fallen 6% compared to last year, Super Midsize departures are the only types that are growing compared to last year.

Although departures have fallen, Ultra Long-Range jets are flying 7% more flight hours compared to last year. Despite the country wide downturn this year, busiest bizjet airport Munich (EDDM) is 8% ahead of last year, contrast Stuttgart, down 24%.

Business jet departures from Germany by operator type, 1st January-February 23rd 2025.

click image to enlarge

Rest of the World

Outside of the US and Europe, other regions of the world saw an 8% year on year increase in Week 8 activity. Activity in the Middle East and Asia saw 8% and 7% growth respectively, Africa well ahead with activity 30% higher than last year.

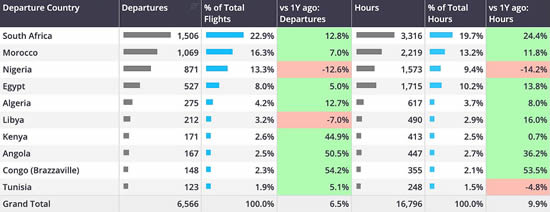

So far this year bizjet activity in Africa is 7% ahead of last year, flight hours 10% ahead of last year. South Africa and Morocco appear to be responsible for the gains on the African continent, bizjet departures up 13% and 7% respectively. Nigeria and Libya bucking the regional trend with downturn. Domestic activity is responsible for growth in South Africa, large increases in demand between Cape Town and Durban. In Morocco domestic activity has fallen slightly, the country’s busiest international connection is to Spain, flights 58% ahead of last year.

Business jet departures by country, Africa, 1stJanuary -23rd February 2025.

click image to enlarge

Managing Director Richard Koe comments: “The demand for business jets remains resilient despite growing concerns for the global economy, with Florida still booming, though Germany’s political strife is reflected in significantly less flying this year.”

“The demand for business jets remains resilient despite growing concerns for the global economy, with Florida still booming, though Germany’s political strife is reflected in significantly less flying this year.”

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 27th February 2025 | Issue #785

Add BlueSky to your marketing mix in 2025!

Unbeatable ad rates | Request our rate card here

| © BlueSky Business Aviation News Ltd 2008-2025 |