WINGX Global Market Tracker:

US bizjet activity rebounds in first week March, notably in Florida and Texas

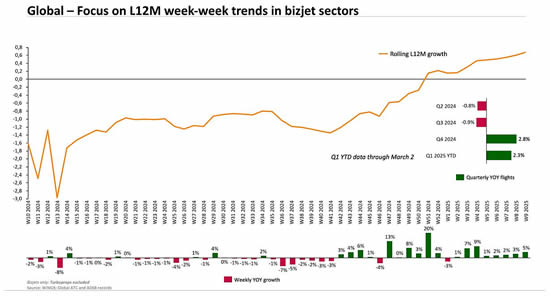

Worldwide business jet sectors in Week 9 (24th February - 2nd March) were up 5% compared to the same week in 2024. This was relatively the strongest week YOY since the end of January, according to WINGX`s weekly Global Market Tracker published today.

Year-to-date, global bizjet activity is up 2%, whereas in the first 10 weeks of 2024,the market was tilting down by 2% compared to 2023.

YOY week-week view of global bizjet flights.

click image to enlarge

United States

In Week 9, business jet activity in the United States was strongest in Florida and Texas, flight departures up 6% and 8% respectively. US Part135 and 91K activity was notably buoyant in W9, departures 8% ahead of last year.

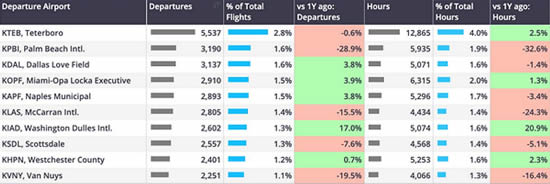

For the month of February, US airports saw varying trends, with some gains at top airport Teterboro and Washington Dulles, but substantial dips from Palm Beach and McCarran.

Overall, business jet activity across the US in February fell 1% compared to last year (noting the absence of the leap year), still 27% ahead of February 2019. Year to date (1st January - 2nd March), bizjet departures and flight hours are 3% ahead of last year, and since the US election (November 6th 2024 - March 2nd 2025) bizjet hours and departures are trending up 4% on the same period across 2023 and 2024. At a cabin-level, super-midsize jet activity is driving the growth, with fractional operators still taking more share of overall flying.

US Business jet departures and flight hours by airport, February 2025 vs last year.

click image to enlarge

European Region

In Week 9, European bizjet activity was on par with last year, flights on aircraft with commercial AOC’s falling 3%. Activity in the UK dropped 1% compared to last year, even further in France and Germany; -4% and -6% respectively. Small growth in Switzerland and Italy, departures 8% and 9% ahead of last year.

Business jet activity in February fell 4% compared to last year, behind the year-to-date trend of -1%. A total of 33,887 bizjet departures were recorded, 1% fewer than February 2019. Top market France saw activity fall 5% behind last year, United Kingdom fared better, departures down just 2% year on year.

Despite Februarys declines, year-to-date, France and the United Kingdom remain 2% and 1% ahead of 2024. Germany’s losses extended, February activity was 11% behind last year, taking the year-to-date trend to -7% vs last year.

Spain was an outlier in February, joining Belgium as the only two countries in the top 10 to see bizjet activity grow compared to last year. Spain’s growth last month appears to be coming from a strong domestic market, bizjet sectors on domestic flights up 8% compared to last February.

Business jet departures by country, Europe, February 2025.

click image to enlarge

Rest of the World

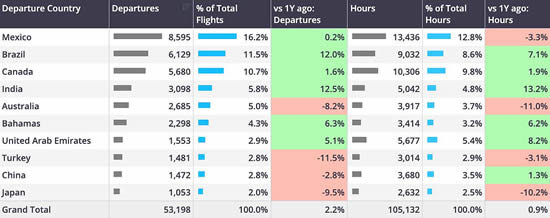

In markets outside of the United States and Europe, bizjet activity in W9 grew 7% compared to last year. Large rises recorded in Africa and South America; departures up 21% and 30% respectively. In the Middle East activity fell 11% compared W9 in 2024, departures in Asia fell 4% compared to W9 2024. Activity outside of the United States and Europe grew 2% compared to February last year.

Top ROW market was Mexico, bizjet departures on par with last year. Strong growth in Brazil and India, bizjet departures 12% and 13% ahead of last year respectively.

In contrast, activity in Australia was 8% below last year.

Business jet departures by country, excluding the US and Europe, February 2025.

click image to enlarge

Managing Director Richard Koe comments: “Business jet activity has remained very firm in the last 3 months, representing a genuine rebound from flatline trends in 2023 and 2024. In the most recent week, demand was notably strong to and from Washington DC, unsurprisingly.

"European markets are generally behind at the start of March, with Germany the most obvious laggard.”

“Business jet activity has remained very firm in the last 3 months, representing a genuine rebound from flatline trends in 2023 and 2024. In the most recent week, demand was notably strong to and from Washington DC, unsurprisingly.

"European markets are generally behind at the start of March, with Germany the most obvious laggard.”

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 6th March 2025 | Issue #786

Add BlueSky to your marketing mix in 2025!

Unbeatable ad rates | Request our rate card here

| © BlueSky Business Aviation News Ltd 2008-2025 |