Dallas, TexasAero Asset report reveals rising preowned twin-engine helicopter prices despite mixed market performance |

Global helicopter sales and market intelligence firm, Aero-Asset, kicked off Verticon 2025 with the release of its 2024 Annual Heli Market Trends Twin-Engine Edition, offering in-depth insights into the evolving preowned twin-engine helicopter market.

The report revealed that pricing for preowned twin-engine helicopters held strong last year despite supply and performance shifts across market segments.

“Our research shows a slowdown in 2024 deal volume and a growing supply for sale,” said Valerie Pereira, Vice President of Market Research at Aero Asset.

“However, the resilience in transaction prices - an 11% year-over-year increase - highlights the continued demand for quality preowned twin-engine helicopters, despite supply fluctuations.”

Drawing from proprietary market intelligence, Aero Asset’s 2024 Annual Heli Market Trends Twin-Engine Edition provides a detailed analysis of trends shaping the industry.

Key highlights from the report

Market Trends

-

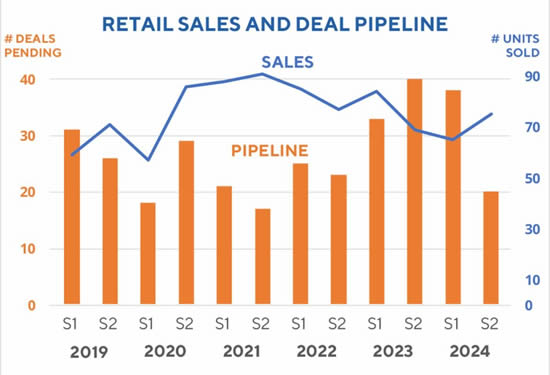

Retail sales volume of preowned twin-engine helicopters declined by 8% year-over-year (YOY) in 2024.

-

Supply for sale increased 14% YOY, while absorption rates rose to 16 months of supply at current trade levels.

Weight Class Performance

-

Light twin-engine helicopters: Sales remained steady, but supply surged 33% YOY.

-

Medium twin-engine helicopters: Retail sales declined 22%, while supply dropped 15% YOY.

-

Heavy twin-engine helicopters: Supply increased 13% YOY, but retail sales hit a five-year low S2 2024.

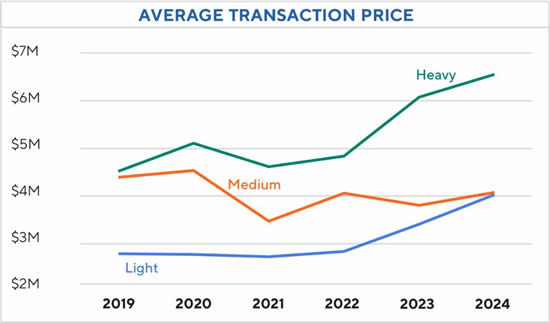

Average Transaction Prices

-

Overall average transaction price (ATP) of preowned twin-engine helicopters was 11% higher YOY.

-

Light twin-engine helicopters reached a five-year ATP peak in S2 2024.

-

Medium and heavy twin-engine helicopters recorded an 8% YOY price increase.

Regional Shifts

-

In 2024, Europe led in retail sales growth, surging 29% YOY.

-

North America followed with a 6% YOY increase, accounting for 36% of global transactions, while Europe closely trailed at 32%.

-

Supply for sale grew in Europe, Asia Pacific, and Latin America, but declined in other regions.

Liquidity Lineup

-

The Airbus EC/H145 was the best-performing preowned twin-engine model in 2024.

-

The EC/H135 and Leonardo AW109S/SP also ranked among the strongest contenders.

-

The Sikorsky S76D and Airbus EC/H225 markets were the weakest performers.

Deal Pipeline

-

At the close of Q4 2024, only 20 twin-engine retail transactions were pending, marking a three-year low.

-

The number of transactions in progress was 50% lower Q4 2024 vs. 2023, signaling a possible cooling trend.

Download the 2024 Annual Heli Market Trends Twin-Engine Edition: aeroasset.com/report.

This year’s edition also includes an interview with Jason Kmiecik, President and Owner of HeliValue$, Inc., and publisher of The Official Helicopter Blue Book, the accepted standard for helicopter resale pricing information.

![]()

BlueSky Business Aviation News | 13th March 2025 | Issue #787

Add BlueSky to your marketing mix in 2025!

Unbeatable ad rates | Request our rate card here