WINGX Global Market Tracker:

Bizjet Spring Break surge in the US

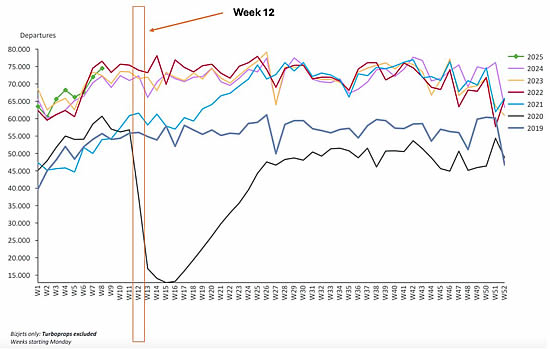

This week, Week 12 (17th-23rd March), global business jet sectors grew 2% compared to last year, slightly behind the last four-week trend of +3%, according to WINGX`s weekly Global Market Tracker pubished this week

Aircraft flying on Part 135 & 91K certificates flew 5% more sectors than Week 12 last year, ahead of the last four-week trend of +4%. As March draws to a close, global bizjet activity is 2% ahead of March 2024, slightly behind the year-to-date trend of +3%.

Five years ago this week Coronavirus lockdowns were beginning to be implemented globally, resulting in the grounding of vast numbers of aircraft. In Week 12 of 2020, just 37,379 business jet departures were recorded globally, a decrease of one third compared to Week 12 in 2019.

Global bizjet departures by week, highlighting drop in 2020 due to Coronavirus lockdowns.

click image to enlarge

North America

In Week 12 business jet activity was 3% ahead of Week 12 in 2024. In Week 12 in 2020, just 28,117 business jet departures were recorded in North America, a fall of 34% compared to Week 12 in 2019. The last four-week trend in North America is +4%, Part 135 & 91K activity in the last four weeks is 7% ahead of last year. In the US, activity in Texas in Week 12 was 4% down compared to last year, California up 2%, Florida streaking ahead at +11%.

In Florida, most bizjet flights in Week 12 originated from New York. So far this month, bizjet arrivals into Florida airports are 5% ahead of last year. Arrivals into Palm Beach, which has Temporary Flight Restrictions in place when President Trump is in residence at Mar-A-Lago, are down by 26% compared to March last year.

US States, outbound bizjet departures year-to-date 2025 vs previous years.

click image to enlarge

Tariff watch

So far this month, bizjet departures from the United States to Mexico have fallen 4% below last year, well below the year-to-date trend of +2%. Connections to Canada this month are down by -0.4%, below the year-to-date trend of +1.4%.

The business aviation industry is watching closely if proposed trade tariffs will provide headwinds for non-US manufactured bizjets. Out of the 15,000 active business jets based in the US this year, 4,446 active bizjets based in the US are manufactured by Bombardier (Canada), Dassault (France) and Embraer (Brazil).

Some of the largest US operators could be exposed, Netjets for example has an active fleet of 665 bizjets with a home base in the US, 308 of those aircraft are Bombardier and Embraer aircraft. Flexjet has 269 active aircraft with a US home base this year, 212 are Bombardier and Embraer aircraft.

European Region

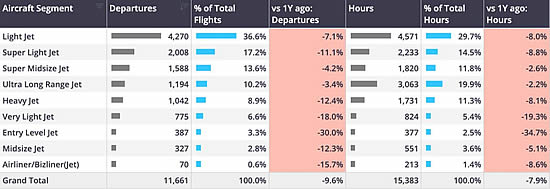

In Week 12 (17th-23rd March), European bizjet activity fell 2% compared to Week 12 in 2024, slightly ahead of the last four-week trend of -3%. Part135 & 91K activity fell 7% compared last year, matching the last four-week trend.

Across Europe, Week 12 trends were mixed. Activity in France grew 10% compared to last year, activity in the UK and Italy grew 5%. In contrast, bizjet departures from Switzerland fell 8%, in Germany activity fell 12%. In the last four weeks, bizjet activity in Germany has fallen 13%, year to date the trend is 10% below comparable last year.

Over a third of bizjet departures this year in Germany are domestic flights, domestic activity down by 14% compared to last year. Busiest international connection is to Switzerland, activity 8% below last year.

Business jet departures by aircraft segment, Germany 1stJanuary-23rd March 2025.

click image to enlarge

Rest of the World

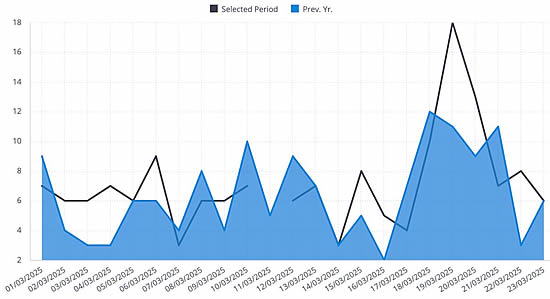

In Week 12, bizjet activity outside of North America and Europe was up 4% compared to Week 12 in 2024. Modest rises in Asia and South America (+3%), stronger trends in the Middle East (+5%) and Africa +7%. In China, Oscar Piastri won the Chinese F1 Grand Prix over the weekend.

Airports near the event (ZSSS & ZSPD) recorded 21 bizjet arrivals during the Grand Prix weekend (21st-24th March), up from 16 on the previous weekend. Year to date, bizjet departures from China are 4% below last year, although flying hours remain on par with last year.

Business jet arrivals into Shanghai airports (ZSSS & ZSPD), highlighting “spike” around F1 Grand Prix event.

click image to enlarge

Managing Director Richard Koe comments: “So far this year business jet activity is robust, with 3% gains on comparable last year, well ahead of pre-pandemic 6 years ago (+35%). As we reach the 5-year anniversary of the initial Coronavirus lockdowns, bizjet activity in Week 12 this year is almost twice as high as Week 12 in 2020.

"In Europe bizjet activity has stalled this year, departures just 1% ahead of pre-pandemic 2019, the market in Germany appearing particularly weak.”

“So far this year business jet activity is robust, with 3% gains on comparable last year, well ahead of pre-pandemic 6 years ago (+35%).

"As we reach the 5-year anniversary of the initial Coronavirus lockdowns, bizjet activity in Week 12 this year is almost twice as high as Week 12 in 2020.

"In Europe bizjet activity has stalled this year, departures just 1% ahead of pre-pandemic 2019, the market in Germany appearing particularly weak.”

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 27th March 2025 | Issue #789

Add BlueSky to your marketing mix in 2025!

Unbeatable ad rates | Request our rate card here

| © BlueSky Business Aviation News Ltd 2008-2025 |