WINGX Global Market Tracker:

Bizjet spike in Europe, whilst US sees jet influx to Augusta

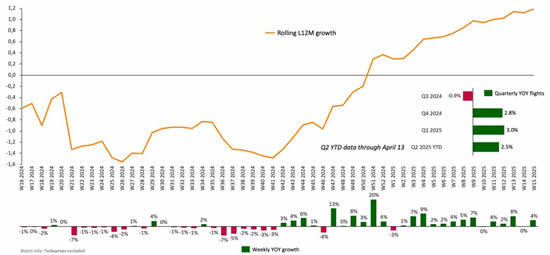

In the week following ‘Liberation Day’, Week 15 (7th-13th April), global business jet flights were actually up 4% compared to the same week last year, with activity up 2% in the core US market, 8% up in Europe and 40% up in the Middle East.

According to WINGX`s weekly Global Market Tracker published today, the last 4-week trend is up 3.5%, with charter and fractional markets slightly trailing at 3% growth trend.

Year to date (1st January-13th April), the global business jet fleet flew just over 1 million departures, 3% more than in the comparable period of 2024.

Global business jet flights and rolling 12-month trends.

click image to enlarge

There has been some particularly strong growth in transatlantic bizjet traffic this month, intercontinental flights up 11% so far this month. In the opening two weeks of this month 586 bizjet sectors have departed North America for European airports, New York - London by far the busiest route, 47 flights so far this month.

Conversely, bizjet activity between the United States and Mexico has fallen 4% compared to last April. Flights between the US and Canada are holding steady this year, up 1% compared to April last year.

Business Jet departures from the US in April 2025 vs last year.

click image to enlarge

North America

Overall, bizjet activity in the US was up 2.3%, with slightly stronger trends in part-135 and part91K traffic. Florida and Texas both saw 9% growth in bizjet flight activity in Week 15, accelerating from 3% growth in the last 4 weeks. The most obvious slowdown this Week is in California, 1% fewer flights this week, 2% weaker in charter operations.

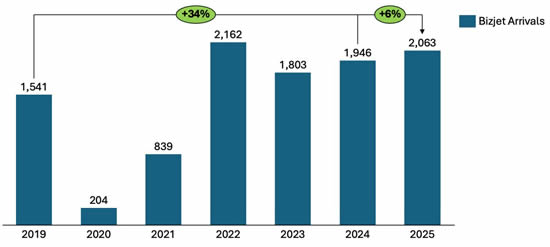

Airports near Augusta, Georgia (KAGS, KAIK, KDNL) saw an influx of business jet arrivals for the Masters Golf tournament in Week 15. There were 2,063 bizjet arrivals recorded at Augusta’s airports, a 613% increase compared to the previous week and a 6% increase on the week when the 2024 event was held.

New York and Atlanta were the busiest origin cities this year, recording 140 and 124 bizjet arrivals respectively. Florida was the busiest origin State, with 436 bizjet departures to Augusta airports; by comparison, there were just 85 flights from Florida to Augusta airports in Week 14. Looking back at the last 6 years, this year’s Masters event attracted 6% more arrivals compared to last year, almost equalling the record peak back in 2022.

Business Jet arrivals into Augusta airports during Augusta Masters Golf Tournament weeks, 2019 to 2025.

click image to enlarge

Europe

Week 15 (7th-13th April) marked three consecutive weeks of year-on-year growth in Europe, the latest week up 8% compared to 2024.

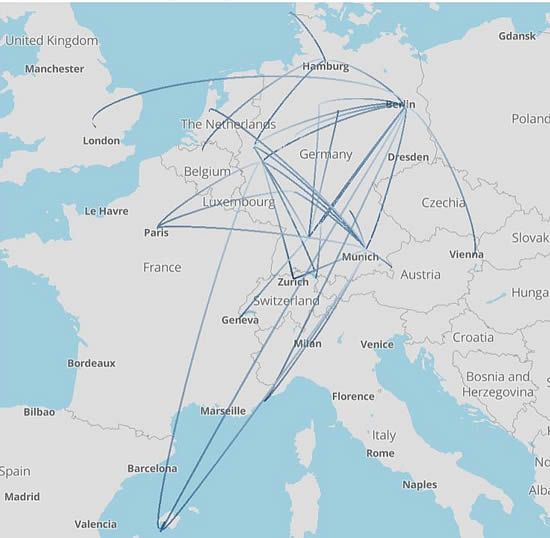

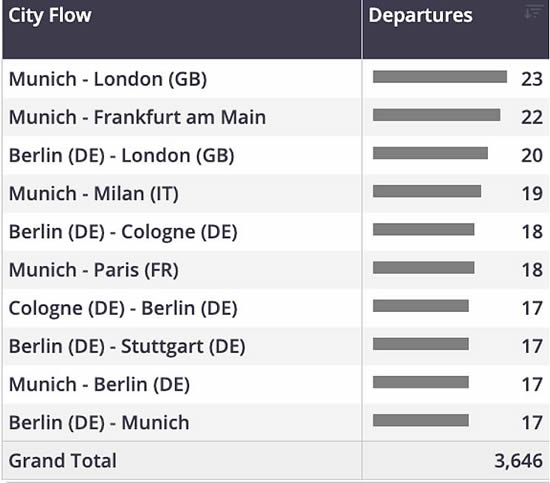

Departures from the UK were up 5% compared to last year, France up 4% and Switzerland up 2%. Germany remains the stand-out market in Europe, departures 17% ahead of Week 15 in 2024, marking the third week in a row for year-on-year growth. Germany’s positive trend reverses trends at the start of the year, where departures fell below last year for each of the first 12 weeks of the year.

In the last three weeks the increased activity is being driven by Aircraft Management and Fractional fleets, which flew an additional 31% departures in the last three weeks compared to Weeks 13, 14 & 15 in 2024.

Business jet city flows from Germany, last three weeks (24th March-13th April).

click images to enlarge

Rest of the World

In Week 15, business jet activity outside of North America and Europe was up 13% compared to Week 15 last year. Most of the gains in Week 15 came from the Middle East, departures in Week 15 up 40% compared to Week 15 last week.

The F1 Grand Prix in Bahrain drew a substantial jump in business jet arrivals, 101 inbound flights compared to an average of 35 arrivals so far this year. Elsewhere In Asia, departures fell 2%, bucking the ROW trend. In South America sectors were up 10%, and in Africa, 977 business jet sectors were operated, up 26%.

Managing Director Richard Koe comments: “As yet, there is little sign of a slowdown in business jet demand as a result of the volatility in financial conditions triggered by Liberation Day. Indeed there was some unusual growth in bizjet activity in some markets this Week, most notably in Europe.

"It may even be that the bounce in flight activity this week reflects business opportunities which need to be realised during the brief respite from the full tariff program.”

“As yet, there is little sign of a slowdown in business jet demand as a result of the volatility in financial conditions triggered by Liberation Day.

"Indeed there was some unusual growth in bizjet activity in some markets this Week, most notably in Europe.

"It may even be that the bounce in flight activity this week reflects business opportunities which need to be realised during the brief respite from the full tariff program.”

Richard Koe, Managing Director, WINGX.

WINGX GmbH

Lilienstraße 11

20095 Hamburg

Germany.

+49 40 23 96 85 05

BlueSky Business Aviation News | 17th April 2025 | Issue #792

Add BlueSky to your marketing mix in 2025!

Unbeatable ad rates | Request our rate card here

| © BlueSky Business Aviation News Ltd 2008-2025 |