|

There were 67,231 business aviation departures in

Europe in March 2017 according to WINGX`s latest monthly Business Aviation

Monitor. The figure underscores a

conspicuous growth month - up 8% YOY - which is partly explained by Easter dates

falling in March last year and April this year. Following Q1, business aviation

activity in 2017 is +5% vs comparable 2016.

All fleet categories - business jets, props,

pistons - increased YOY activity this month. Props and Pistons had relatively

the strongest growth, but business jets generated almost 60% of overall

activity, with flights up by 6% YOY.

Central Europe; Germany, Austria and

Switzerland, saw strongest regional growth. Flights from Germany were up 18% YOY,

strongest on domestic sectors and in connections with UK and France. Average

monthly growth in Germany in Q1 was 855 flights.

France remains the busiest market, with 22% of

total European activity, this month`s 4% growth adding 560 YOY flights. Activity

out of the UK continues to grow, with direct connections to EU destinations up

by 7% YOY this month.

|

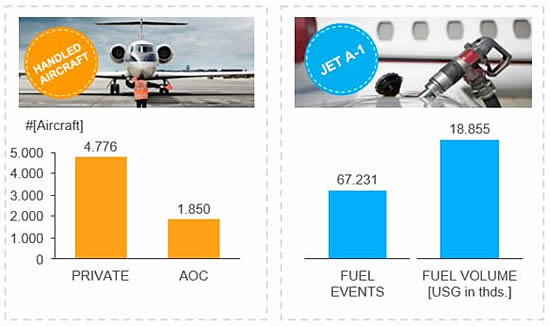

Number of

aircraft handled and fuelled |

|

|

4,776

different aircraft on Owner activity in March. Total fuel volumes

were 18.9M USG. |

Whereas flights within Europe were well up

this month, over 8% YOY, flights to Middle East and CIS region declined. Flights

from Europe to North America and Africa had double-digit growth. Arrivals into

Europe from West Africa declined 11%.

The largest share of flights this month were

Private mission, these increasing 6.5% YOY, following several months of decline.

AOC activity was up 10% YOY, maintaining a positive last 12 months and strong

growth in Q1 2017.

AOC activity was up YOY in 9 of the busiest 10

countries this month, with >10% growth in all top 5 countries, including Italy,

despite its 10% fall in Private flights. Germany, Scandinavia and Turkey saw

very strong increase in Private flight activity.

Aircraft

Bizliner and Midsize Jet activity declined

substantially this month, but all other segments were up, with strongest YOY

growth for Ultra-Long, Light and Very-Light Jets. These segments have increased

activity in all but 2 of the last 12 months.

Airports

Business aviation activity was well up this

month across almost all busiest airports, with Vnukovo and Linate exceptions. Le

Bourget and Geneva posted strong growth. Exceptionally strong growth at

Schoenefeld. Activity at Cannes declined by 21% YOY.

Richard Koe,

Managing Director of WINGX Advance, comments: “This month`s notably strong YOY

growth was flattered by this year`s later Easter. Even so, growth in March

rounded off the most positive Q1 for some years. Activity in Germany is on the

rebound after a weak 2016, whilst France and UK sustained strong activity trends

despite macroeconomic turbulence. The Charter market is generating most activity

growth, especially in Light Jet segments. Despite some growth in Owner activity

this month, the trend appears to show business jet travellers increasingly

preferring the spot charter market.”

Download the current Business Aviation Monitor

WINGX

Advance is a data research and consulting

company based in Hamburg, Germany. WINGX

analysis provides actionable market intelligence

for the business aviation industry. WINGX

services include: Market Intelligence Briefings,

Customised Research, Strategic Consulting,

Market Surveys. WINGX customers range from

aircraft operators, OEMs, airlines, maintenance

providers, airports, fixed base operators, fuel

providers, regulators, legal advisors, leasing

companies, banks, investors and private jet

users. |