There were 63,587 business

aviation departures in Europe in April 2017 according to WINGX`s latest

monthly Business Aviation Monitor. The figure represents a 1% YOY slowdown

in activity.

Business jet activity was

flat, Piston flights were up and Turboprops were down. Combined flight hours

were up by 4% YOY. YTD-2017 business aviation activity is still up by 4%.

This month´s YOY trend was

clearly affected by the later timing of the Easter break, which slowed

activity in the latter half of April, particularly in Central, Western and

Northern Europe. Conversely, the later Easter boosted activity in Southern

Europe.

Germany took the brunt of the

declining activity this month, with business aviation flights down by 11%.

The biggest drop came in business jets departures, dropping 17%. Germany

domestic and Germany to UK flights declined by most.

Flight activity from France

continued to increase, sustaining a YTD trend of 4%. UK activity was

slightly down, and Italy maintained YTD decline. In contrast, flight

activity in Spain jumped more than 20%. Flights from Switzerland and Russia

were slightly up.

Whilst overall activity

within Europe declined this month, there was strong growth in flight

arrivals from Africa and Asia. Arrivals from Middle East and CIS region were

moderately up. Transatlantic arrivals slumped 12% YOY and are trending down

this year.

|

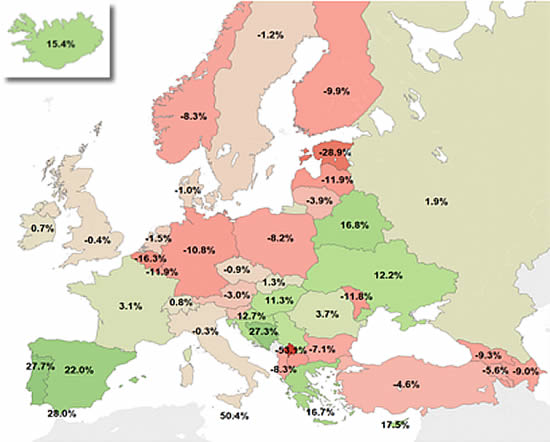

The year on

year trend in flight activity |

|

|

Declining activity in Northern Europe but strong growth around the

Med. |

Contrasting trends this month between Private

and AOC flights, with Private flights declining 5%, maintaining a slowing trend

over the last 12 months, whereas AOC flights were up 4% and have increased in

each of the last 6 months.

AOC activity was well up in several countries,

more than 10% in Italy, 15% in France, and more than 20% in Spain and Greece,

almost 40% in Portugal. Conversely, Private flights declined in all top 5

markets, and by around 10% in Germany, Italy, Belgium.

Aircraft

Most aircraft segments saw some decline this

month, mainly in ELJ and MSJ, but also in ULR jets for the first time since

2015, although only due to fewer Private flights. Strong growth in VLJ activity

continues, mainly in Private flights.

Airports

Business aviation activity was up for most of

the busiest airports, however Geneva was flat and the top German airports all

declined, notably Munich and Schoenefeld. There was strong growth, especially in

AOC business jet activity, from Nice, Biggin Hill and Mallorca.

Richard Koe,

Managing Director of WINGX Advance, comments: “Clearly the slowdown this month

was due to the later timing of Easter this year, which shows that business

aviation is about ´business´ in Northern Europe, whereas the Easter vacation

period saw an increase in leisure flights to Southern Europe. A number of city

pairs are well up YTD, including those which have regular airline connections,

which underlines the attractiveness of convenience and comfort even where

business aviation is more expensive than flying commercial. Hybrid business

aviation shuttles seem to be supporting this trend.”

Download the April Business Aviation Monitor

WINGX

Advance is a data research and consulting

company based in Hamburg, Germany. WINGX

analysis provides actionable market intelligence

for the business aviation industry. WINGX

services include: Market Intelligence Briefings,

Customised Research, Strategic Consulting,

Market Surveys. WINGX customers range from

aircraft operators, OEMs, airlines, maintenance

providers, airports, fixed base operators, fuel

providers, regulators, legal advisors, leasing

companies, banks, investors and private jet

users. |