June was the busiest month so far in 2017 -

with some 84,000 departures - according to WINGX`s latest monthly Business

Aviation Monitor published today.

The figure represents an increase of 2.7% YOY,

taking the trend for the first half of the year to 3.1% - an additional 12,000

flights compared to H1-2016. However, activity in June 2017 was still 4.5% down

on a decade ago.

Europe´s busiest market, France, saw a 6% drop

in business aviation activity, but that was due to the unusually high level of

activity during the Euro Football Championships last summer. Flight activity in

France is still up by 1% on a YTD basis.

Other large business aviation markets saw

growth this month, modest for Germany, Switzerland, UK, but more than 10% YOY in

Spain and Italy. Biggest growth in country flows was evident between Germany and

Spain, UK and Italy. Overall, flights in Southern Europe were up by 12% YOY in

June, taking the 6 month trend for this region to 6%. Departures from Eastern

Europe were up by 8% in June. Activity in the Russia market was flat, improving

on a L12M trend of -4%.

Transatlantic arrivals into Europe were up by

12% this month. More modest growth of 3% in arrivals from the Middle East.

Arrivals from North Africa were down 6%, but trending up 9% YTD. Arrivals from

Asia were up 14% this month.

Aircraft

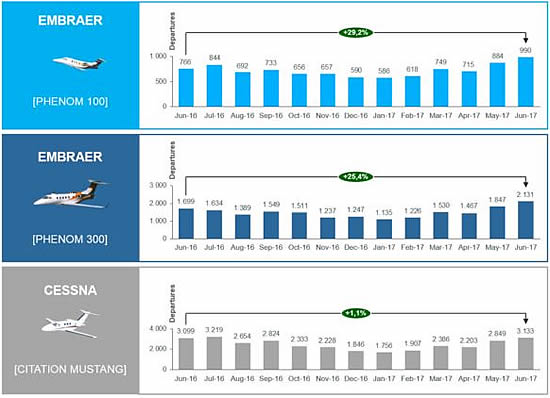

Of the biggest OEM fleets, Cessna activity was

up by 4%, strongest in Midsize, VLJ and Prop segments. Bombardier flight sectors

were up by 10%, strongest in the ULR segment. Embraer aircraft flew 5,196

sectors, up 23% YOY.

|

Popular types

of business aviation aircraft |

|

|

Phenom

100 and Phenom 300 jets continue to be in very strong demand in

Europe. |

Most business jet segments saw some growth

this month, the exceptions being the older Entry Level and Midsize Jets, with

notable declines on the Hawker 700-900 platform and on CJ1 and CJ2 aircraft. SLJ,

VLJ, SMJ segments posted 12th consecutive months of growth. Private flights

slightly decreased this month, with largest declines in France, Germany, UK,

Switzerland. AOC activity maintained its growth in every month this year, with

trends strongest this month in Germany, Italy and Spain.

Airports

The busiest airports saw some declines this

month - at Le Bourget, Nice, Ciampino. Smaller airports saw strong growth in YOY

activity, with flights from Mallorca, Biggin Hill and Ibiza respectively growing

14%, 18% and 25%.

Richard Koe,

Managing Director of WINGX Advance, comments: “Another solid growth month for

business aviation activity in Europe, despite the absence of the Euro football

championship finals which boosted activity last year. Southern Europe is seeing

strongest regional growth, reflecting the increase in activity at the most

popular Med resorts such as Ibiza and Mallorca. Primarily, charter demand is

driving this activity growth. London, Madrid and Berlin appear to be the most

frequent connection points for this surge in flights. The signs are that summer

2017 could be a hot one for the European charter market.”

Click

here to view the current Business Aviation Monitor.

Click

here

to receive your free monthly copy.

WINGX

Advance is a data research and consulting

company based in Hamburg, Germany. WINGX

analysis provides actionable market intelligence

for the business aviation industry. WINGX

services include: Market Intelligence Briefings,

Customised Research, Strategic Consulting,

Market Surveys. WINGX customers range from

aircraft operators, OEMs, airlines, maintenance

providers, airports, fixed base operators, fuel

providers, regulators, legal advisors, leasing

companies, banks, investors and private jet

users.