|

|

|

Growth trends strengthen as winter draws in |

|

|

November was another

growth month for business aviation in Europe, with 61,837 flight

departures, up 6.1% YOY, taking the YTD growth trend to 4.2%,

according to WINGX`s latest monthly Business Aviation Monitor.

Activity in November 2017 was

still 10.5% behind the pre-crisis peak back in November-2007.

Continuing the recent trend, the

biggest growth came in Western Europe, with business aviation departures up

significantly from leading markets UK, Spain and Switzerland. For the

year-to-date, Germany has added the most flights.

Of the smaller markets, Greece,

Belgium, and Portugal had well over 15% growth this month, with flights from

Poland and Croatia up 25% YOY. Business aviation flights from Turkey were down

12%, but still have 6% growth YTD.

France was by far the busiest

domestic market, with 7,000 flights, up 2% YOY. Flights from France to Germany

were up 11%, and from France to Spain, up 31%. Flights within the UK were up 10%

this month. Domestic flights in Italy declined 3%.

Business aviation arrivals into

Europe were up due to strong growth in transatlantic connections; elsewhere,

arrivals from CIS region and Middle East were flat, and North Africa arrivals

were down. Flights to Latin America declined 5% YOY.

|

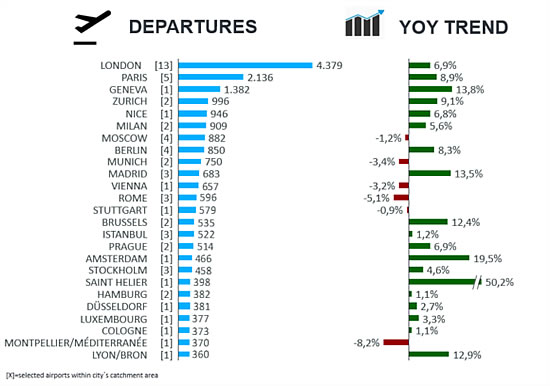

Activity trend by City |

|

|

Over 6,500 flights from

London and Paris this month. Geneva departures up by 14% YOY. |

AOC activity continued to be the

main overall growth driver, representing 47% of activity and up 10% YOY. Charter

growth rates since the summer have exceeded 8% each month. Private activity

slightly improved this month, although flat for business jet sectors.

Aircraft

The growth in AOC operations this

month came mainly in large cabin sectors, with Ultra-Long Range and Heavy Jet

flights up almost 20%. Light Jet activity was up 9%, and has increased every

month this year. Only Midsize jets flew less YOY this month.

Besides the continued strong

growth in newer business jet platforms such as Phenom 300 and Global Express,

older types such as Challenger 600 saw substantial increase in AOC activity, and

in Private flights, the CJ2 was up by 25% YOY.

Airports

Solid growth at leading airports

Le Bourget and Nice, the latter adding most growth of any airport this year.

Notably Geneva saw 13% growth in departures, all from increased AOC activity.

Ibiza had 15% growth and Biggin Hill departures were up by 23% YOY.

Richard Koe,

Managing Director of WINGX Advance, comments:

“November´s flight activity was

typically low-season but the strong year-on-year growth is evidence of the

ongoing recovery in demand in 2017. A lot of the additional flying is being

operated as large cabin AOC missions, on short European sectors, suggesting some

aggressive pricing. Excess capacity is encouraging the buyer´s market; overall

activity this month was still down 10% on the levels of a decade ago, despite

the much larger active fleet of aircraft.”

Download the latest Business Aviation Monitor

WINGX

Advance is a data research and consulting

company based in Hamburg, Germany. WINGX

analysis provides actionable market intelligence

for the business aviation industry. WINGX

services include: Market Intelligence Briefings,

Customised Research, Strategic Consulting,

Market Surveys. WINGX customers range from

aircraft operators, OEMs, airlines, maintenance

providers, airports, fixed base operators, fuel

providers, regulators, legal advisors, leasing

companies, banks, investors and private jet

users.

|

|

|

|

| WINGX

Advance GmbH |

|

Conventstr. 8 - 10 | Building

A |

| D

- 22089 Hamburg |

| Germany. |

|

| +49

40 32 84 69 78 phone | +49 40 32 84 69 79 fax |

|

|

|

BlueSky Business Aviation News | 14th December

2017 | Issue #443 |

|