| |

|

|

|

Charter demand driving activity growth in Europe |

|

|

A total of 57,037 flights during February

marked a 4.5% increase in year-on-year activity and continued the solid growth

of business aviation in Europe, according to WINGX`s latest monthly Business

Aviation Monitor.

Business jet departures were up by 3%, with a decline in Private flight missions

offset by 5% gains in Charter activity.

Western and Central Europe saw robust growth in flight activity, although flat

in the UK and modest in Italy. Germany had the strongest growth, mainly growth

in Prop activity. Spain had the largest growth in business jet activity, with a

+9% trend over the last twelve months.

Large jet activity was mixed during February, with a 6% increase in flights from

top market, France; up 4% in Switzerland; down 6% in Germany; and -11% in Italy.

Small jet flights were modestly up in the top 3 markets, and up by 17% YOY from

Spain.

AOC activity was the growth driver once again, with France and Germany seeing

over 10% growth in these missions. There was exceptional YOY growth in Belgium

and Finland, although the UK charter market was down slightly. AOC market

declined 12% in Czech Republic.

Private activity was slightly up overall this month, but wavered in France,

Switzerland and Russia. Owner flights were well up in UK, with over 4,000

flights out of the London airports in February, this volume up by 2.5% YOY.

90% of flights from Europe stayed within the region, this volume up by 5% YOY.

Flights inbound to Europe from other global regions were down, with arrivals

from the Middle East down by 15%, and Transatlantic arrivals down by 5% YOY.

Within Europe, there were almost 300 flights on the busiest connection between

Le Bourget and Geneva, but whilst this volume was flat YOY, AOC traffic between

airports including Farnborough, Nice, Le Bourget, Vnukovo and Zurich was up by

around 20% YOY.

|

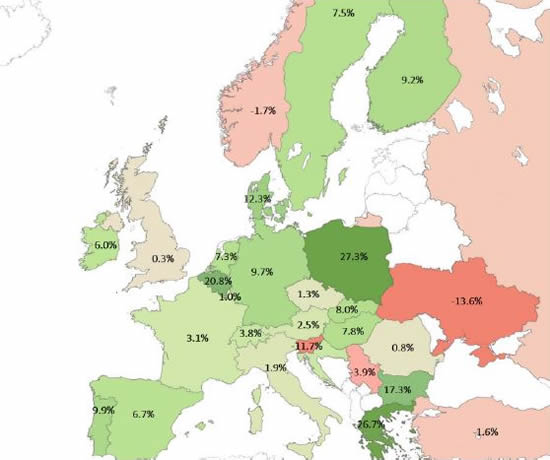

February 2018: YOY Trend |

|

Aircraft

Light Jets, mostly for Charter sectors, and Super Midsize, mostly Fractional,

saw the largest pick-up in demand, mainly on short sectors. Owner flights on

Midsize, Entry Level and VLJ flights was well down. SLJ Charter flights also

declined.

The busiest 10 airports all saw some increase in YOY activity this month, modest

at Le Bourget, Vnukovo and Zurich, substantial at Farnborough, Geneva, Nice and

Biggin Hill. AOC departures from Farnborough were up more than 30% YOY.

Richard Koe,

Managing Director of WINGX Advance, comments: “Activity has softened in some

countries, with the political climate probably showing through in UK and Italy.

The main leisure markets still look strong, with Charter flights to and from

Spain well up, and airport pairs connecting London, Paris and the South of

France showing very strong growth. Short commercial sectors are seeing most

growth, especially on Light Jets. Owner activity remains very subdued.’

Airports

The busiest 10 airports all saw some increase in YOY activity this month, modest

at Le Bourget, Vnukovo and Zurich, substantial at Farnborough, Geneva, Nice and

Biggin Hill. AOC departures from Farnborough were up more than 30% YOY.

Richard Koe,

Managing Director of WINGX Advance, comments: “Activity has softened in some

countries, with the political climate probably showing through in UK and Italy.

The main leisure markets still look strong, with Charter flights to and from

Spain well up, and airport pairs connecting London, Paris and the South of

France showing very strong growth. Short commercial sectors are seeing most

growth, especially on Light Jets. Owner activity remains very subdued.’

Download the latest Business Aviation Monitor

WINGX

Advance is a data research and consulting

company based in Hamburg, Germany. WINGX

analysis provides actionable market intelligence

for the business aviation industry. WINGX

services include: Market Intelligence Briefings,

Customised Research, Strategic Consulting,

Market Surveys. WINGX customers range from

aircraft operators, OEMs, airlines, maintenance

providers, airports, fixed base operators, fuel

providers, regulators, legal advisors, leasing

companies, banks, investors and private jet

users.

|

|

|

|

| WINGX

Advance GmbH |

|

Conventstr. 8 - 10 | Building

A |

| D

- 22089 Hamburg |

| Germany. |

|

| +49

40 32 84 69 78 phone | +49 40 32 84 69 79 fax |

|

|

|

BlueSky Business Aviation News | 8th February

2018 | Issue #454 |

|

|

|

|

|

|